Getting Started with Finance with AI Beginner’s Guide for Professionals

How is AI Transforming the Future of Finance?

The world of finance with AI is undergoing a rapid transformation, reshaping how organizations manage risks, optimize portfolios, detect fraud, and deliver personalized services. As financial markets grow more complex and data-driven, artificial intelligence is stepping in as a powerful force enhancing decision-making and driving efficiency across all sectors of the industry.

In recent years, the relationship between finance and emerging technologies has become increasingly intertwined. From automating routine tasks to enabling predictive analytics, AI is not just a tool—it's a game-changer. Banks, investment firms, insurance companies, and fintech start-ups are now leveraging AI technologies to gain a competitive edge and deliver greater value to clients. Whether through intelligent chatbots, algorithmic trading, or real-time risk modelling, the impact of AI on financial services is profound and only expected to grow.

This guide is designed to help both beginners and seasoned professionals navigate this evolving landscape. If you're new to the concept, you'll gain a clear understanding of how AI is applied in financial settings. For those already working in finance, this guide offers practical insights into integrating AI tools into your existing workflows, staying competitive, and preparing for future disruptions.

To support your journey, LAI’s AI courses for finance professionals provide structured learning paths tailored to various experience levels. These courses cover essential topics such as AI in financial modelling, fraud detection, algorithmic trading, and regulatory compliance ensuring you're equipped with both theoretical foundations and hands-on skills.

Whether you're aiming to future-proof your career or drive innovation within your organization, this guide will serve as your starting point to mastering the fusion of finance and artificial intelligence.

What Happens when Finance Meets AI?

Artificial Intelligence (AI) is revolutionizing industries, and finance is no exception. To grasp its impact, it’s essential to understand how these two fields come together to drive smarter, faster, and more efficient outcomes.

What is AI in Simple Terms?

At its core, AI refers to the ability of machines to simulate human intelligence. This includes learning from data, recognizing patterns, making decisions, and improving over time. In the financial world, AI enables systems to analyse massive datasets, automate processes, and deliver insights that would be nearly impossible for humans to uncover alone.

How Finance and AI Work Together?

The integration of finance and AI is creating a powerful synergy. Financial institutions are using AI to enhance customer experience, manage risk, and improve decision-making. AI systems can process and interpret financial data at a speed and scale beyond human capacity—transforming everything from banking operations to investment strategies.

Key AI Technologies Used in Finance

Several core AI technologies are driving this transformation:

- Machine Learning (ML): Enables systems to learn from historical data and improve predictions, such as in stock price forecasting or credit risk assessment.

- Natural Language Processing (NLP): Allows machines to understand and respond to human language, powering chatbots and automated customer support.

- Predictive Analytics: Uses past data to anticipate future trends and behaviours, essential for financial planning and fraud prevention.

Real-World Applications in Finance

Examples of AI-powered solutions in finance in action include:

- Fraud Detection: AI can detect unusual patterns in transactions, alerting institutions to potential fraud in real time.

- Credit Scoring: Machine learning models assess a borrower’s creditworthiness more accurately than traditional methods.

- Robo-Advisors: These AI-powered platforms provide automated, algorithm-driven financial planning services without human intervention.

Together, these technologies are redefining the future of finance.

Why Professionals Should Learn Finance with AI in 2025?

The financial sector is evolving rapidly, and 2025 marks a critical turning point for professionals aiming to stay competitive. As AI becomes embedded in every aspect of financial operations, acquiring skills in finance with AI is no longer optional—it’s a strategic career move.

Industry Trends and Rising Demand

Financial institutions are heavily investing in AI-powered solutions to enhance efficiency, security, and decision-making. According to recent market reports, AI in the finance industry is expected to grow at a double-digit rate through 2030. This growth is creating unprecedented demand for professionals who understand both financial principles and AI-driven technologies.

Gaining a Competitive Edge

Professionals who upskill in AI gain a distinct advantage in the job market. Employers are actively seeking individuals who can bridge the gap between technology and finance—those who not only understand financial modelling but can also leverage AI tools for automation, prediction, and analysis.

Impact on Traditional Financial Functions

AI is reshaping core financial functions:

- Accounting: Automation tools powered by AI can process invoices, reconcile transactions, and detect anomalies faster than humans.

- Risk Management: AI models can analyse massive data sets in real-time, identifying hidden risks and market signals.

- Investment Analysis: AI-driven analytics enhance forecasting accuracy, optimize portfolios, and support algorithmic trading.

Professionals must adapt to these shifts or risk becoming obsolete in tech-forward organizations.

Emerging Career Opportunities

New roles are emerging at the intersection of AI and finance, including:

- AI Financial Analyst

- Algorithmic Trading Strategist

- Financial Data Scientist

- Risk Analytics Specialist

As companies continue to innovate, professionals equipped with both financial acumen and AI literacy will lead the way into the next era of finance.

What Core Skills Do you Need to Get Started in Finance with AI?

Stepping into the world of AI-enhanced finance requires a unique blend of technical expertise, financial understanding, and strong soft skills. Whether you're just beginning or transitioning from a traditional finance background, developing the right skill set is essential for success in this evolving field.

Technical Skills

You don’t need to be a data scientist, but having foundational technical skills is a must:

- Basic Python Programming: Python is the go-to language for AI applications in finance because of its simplicity and robust libraries such as Pandas, NumPy, and Scikit-learn.

- Data Analysis: Understanding how to clean, interpret, and visualize financial data is crucial for AI-driven insights.

- AI/ML Fundamentals: A grasp of machine learning concepts such as supervised learning, regression, and classification will help you understand how AI models work behind the scenes.

Financial Knowledge

AI can amplify your financial expertise—but not replace it. You should be confident in:

- Financial Modelling: Building models to analyse performance, assess risks, and project financial outcomes.

- Forecasting: Using historical data to predict future trends in sales, revenue, or market behaviour.

- Risk Evaluation: Understanding and measuring potential financial risks is essential when building or interpreting AI models.

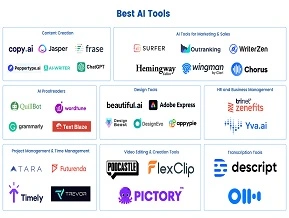

Tools and Platforms

Knowing how to use the right tools is vital:

- Excel + Python: Combine traditional tools with coding to automate tasks and deepen analysis.

- Power BI or Tableau: For interactive financial dashboards and visual reporting.

- AI Tools: Platforms like ChatGPT, Google AutoML, and other no-code/low-code tools can accelerate AI adoption in finance.

Soft Skills

Finally, human skills matter:

- Critical Thinking: Analyse outputs from AI models and challenge assumptions.

- Ethical Judgment: Ensure responsible use of AI in decision-making.

- Communication: Translate technical results into business insights for non-technical stakeholders.

What are Some Beginner-Friendly Use Cases of AI in Finance?

The integration of AI into finance is no longer reserved for experts it’s creating exciting opportunities for beginners as well. With accessible tools and simplified platforms, even entry-level professionals can start leveraging AI to solve real-world problems in finance. Here are some beginner-friendly use cases that demonstrate how AI is reshaping the financial industry.

Automating Data Entry and Reporting

Manual data entry is time-consuming and prone to errors. AI-powered automation tools can extract, categorize, and input financial data from invoices, receipts, and reports with remarkable speed and accuracy. Beginners can use platforms like OCR tools and AI-driven Excel plugins to streamline reporting tasks with minimal training.

Enhancing Customer Service with Chatbots

Financial institutions are now using AI chatbots to handle routine customer queries—such as account balances, transaction history, or loan information—24/7. These chatbots are powered by Natural Language Processing (NLP), enabling them to understand and respond in human-like language.

AI-Driven Investment Strategies

Robo-advisors are AI tools that help users build and manage investment portfolios based on risk profiles and goals. These platforms analyse market trends and rebalance investments automatically. Beginners can explore these strategies through simulations or investment platforms that use AI to recommend assets.

Credit Scoring Using Alternative Data

Traditional credit scoring often excludes individuals with limited credit history. AI models now evaluate alternative data—like utility payments, rent, or mobile usage—to assess creditworthiness. This expands access to financial services and showcases the inclusive power of AI.

Fraud Detection and Risk Management

AI detects unusual patterns in financial transactions and flags them for review—helping prevent fraud and mitigate risk. Entry-level professionals can contribute by learning how these systems are trained and monitored using real-time data.

These applications demonstrate that AI in finance is more accessible than ever, enabling beginners to make meaningful contributions right from the start.

How Can you Start your Journey in Finance with AI?

If you're looking to enter the world of AI-driven finance, you don't need to be an expert in coding or data science from day one. With the right guidance and structured steps, anyone—from finance professionals to students can begin building AI skills that complement and enhance financial expertise. Here’s a beginner-friendly roadmap to get you started.

Step 1: Strengthen your Finance Fundamentals

Before diving into AI, make sure you have a solid understanding of core finance topics like:

- Financial statements

- Budgeting and forecasting

- Risk analysis and valuation

This foundation will help you understand where and how AI can be applied effectively.

Step 2: Learn Python and AI Fundamentals

Python is the most widely used language in AI applications. Start with beginner courses that teach:

- Python syntax and data types

- Data manipulation with Pandas

- Basics of machine learning (ML) and algorithms

Understanding these concepts will open the door to automating financial tasks and building smart financial models.

Step 3: Explore Financial Datasets and Tools

Practice analysing real-world financial data using:

- Python libraries (Pandas, NumPy, Matplotlib)

- Excel for quick calculations and comparisons

- Visualization tools like Power BI or Tableau

The more you interact with data, the more confident you’ll become.

Step 4: Enrol in Beginner AI + Finance Courses

LAI (Learn Artificial Intelligence) offers structured, beginner-friendly courses designed for finance professionals looking to upskill.

Step 5: Build Mini Projects

Apply your learning with small projects like:

- A credit scoring model

- A budget tracker using Python

- A stock price predictor using basic ML

Bonus: Use Recommended Resources

- Free: Coursera, edX, GitHub repos, YouTube tutorials

- Paid: LAI courses, Udemy, DataCamp, LinkedIn Learning

By following this path, you'll gain both confidence and competence to thrive in the AI-powered financial future.

What are the Best Online Courses to Learn Finance and AI?

As the financial industry embraces AI-driven innovation, upskilling through online courses has become essential for professionals and beginners alike. Here’s a guide to some of the best courses available, including specialized programs offered by LAI, designed to equip you with the skills needed to excel at the intersection of finance and AI.

Introduction to AI for Finance

This foundational course covers the basics of AI technologies and their applications in finance. Learners explore how AI enhances financial analysis, automates routine tasks, and improves decision-making. It’s ideal for beginners looking to understand core concepts without overwhelming technical details.

Machine Learning for Financial Forecasting

A step deeper into AI, this course focuses on applying machine learning models to predict market trends, asset prices, and financial risks. You will learn how to use algorithms like regression, classification, and time-series forecasting with real financial datasets, empowering you to create data-driven strategies.

Ethical AI in Finance

As AI systems gain influence in financial decisions, understanding the ethical implications is critical. This course addresses responsible AI use, bias detection, transparency, and regulatory compliance, helping professionals ensure fair and trustworthy AI applications.

LAI’s Specialized Beginner Programs

LAI (Learn Artificial Intelligence) offers targeted beginner-friendly programs specifically tailored for finance professionals. These courses combine practical exercises, industry case studies, and step-by-step guidance to make learning approachable and effective. Whether you want to automate financial reporting or develop robo-advisory skills, LAI’s programs are designed to meet your needs.

Benefits of Learning with LAI

Choosing LAI comes with several advantages:

- Certificates of Completion: Boost your resume and credibility with recognized credentials.

- Mentorship: Access expert support to guide your learning journey and career growth.

- Community: Join a vibrant network of learners and professionals to share insights, solve problems, and collaborate.

By enrolling in these online courses, including LAI’s specialized offerings, you position yourself at the forefront of the evolving finance landscape empowered by AI.

What are Common Challenges when Starting with Finance with AI and How Can you Overcome them?

Entering the world of finance with AI can be exciting but also daunting. Many beginners face challenges that, if unaddressed, may slow down progress or cause frustration. Understanding these common hurdles and practical ways to overcome them will help you build confidence and succeed in this dynamic field.

Fear of Technical Complexity

One of the biggest barriers is the perception that AI is highly technical and difficult to learn. Fortunately, you don’t need to dive into complex coding right away. No-code and low-code AI platforms—like Google AutoML, Microsoft Power Platform, and user-friendly chatbot builders—allow you to experiment with AI applications without programming skills. Starting with these tools builds familiarity and reduces intimidation.

Balancing Financial Logic with Algorithmic Thinking

Finance professionals often think in terms of models, regulations, and business outcomes, while AI requires an algorithmic mindset—breaking problems down into step-by-step logical processes. Bridging these two ways of thinking takes practice. Focus on understanding how AI algorithms solve specific financial problems, and work on projects that combine your finance knowledge with coding exercises. This balanced approach makes the learning curve manageable.

Data Privacy and Compliance Concerns

Finance is a highly regulated industry, and handling sensitive data with AI raises privacy and compliance issues. Familiarize yourself with relevant regulations like GDPR, CCPA, and industry-specific rules. Use anonymized or synthetic datasets for practice, and always apply best practices in data security when deploying AI solutions.

Staying Updated with Rapidly Changing Tools and Trends

AI and finance technologies evolve rapidly, making it easy to feel overwhelmed. Follow reputable sources, subscribe to industry newsletters, join professional communities, and engage in continuous learning through platforms like LAI. Regularly dedicating time to update your skills will keep you ahead of the curve.

Conclusion

Now is the perfect time to embrace finance with AI as the industry rapidly transforms and demand for skilled professionals grows. Starting small whether by learning basic concepts or experimenting with beginner tools and staying consistent will build your confidence and expertise over time. To support your journey, explore LAI’s specialized courses designed for finance professionals looking to master AI applications. Take the next step today: subscribe to updates, enrol in a course, or download a free guide to unlock your potential at the intersection of finance and AI. Your future-ready career starts now.