Finance and AI Trends to Watch in 2025: What’s Next for the Industry?

How is AI Transforming the Finance Industry?

Finance with AI is rapidly reshaping the way financial institutions operate, innovate, and deliver value to their customers. From automating routine tasks to enhancing decision-making through advanced data analytics, artificial intelligence is becoming an indispensable tool in the finance sector. This transformation is not only increasing efficiency but also enabling more personalized services, reducing risks, and improving regulatory compliance.

Understanding the emerging trends in financial technology is crucial for professionals, investors, and businesses aiming to stay competitive in this fast-evolving landscape. As AI technologies such as machine learning, natural language processing, and robotic process automation continue to develop, their applications in finance expand—from fraud detection and credit scoring to algorithmic trading and customer service chatbots. Grasping these trends helps stakeholders anticipate market changes, optimize operations, and make data-driven strategic decisions.

In this introduction, readers can expect to gain a clear understanding of how AI is influencing various aspects of the finance industry. We will explore key innovations, practical use cases, and the implications of adopting AI-driven solutions. Whether you are a finance professional seeking to leverage AI tools, a student interested in fintech, or an entrepreneur looking to innovate, this guide will equip you with the knowledge to navigate and benefit from the integration of AI in finance.

By the end of this section, you will be better prepared to recognize the potential of integrating artificial intelligence into finance and understand why staying informed about these emerging trends is vital for success in today’s dynamic financial environment.

What Does the Current Landscape of Finance and AI Look Like?

How AI is Being Used in Finance Today?

The integration of finance and AI is transforming the financial services industry by automating routine tasks, enhancing decision-making, and improving customer experiences. Financial institutions are increasingly leveraging AI to streamline operations such as transaction processing, compliance monitoring, and customer support. AI-powered systems can analyse massive amounts of data faster than humans, enabling quicker responses to market changes and regulatory requirements. This adoption not only reduces operational costs but also helps identify opportunities for growth and risk mitigation.

Key AI Technologies Shaping the Industry

Several AI technologies are driving innovation in finance. Machine learning (ML) models analyse historical and real-time data to predict market trends, optimize portfolios, and detect fraudulent activities. Natural Language Processing (NLP) enables chatbots and virtual assistants to provide personalized customer service, answer queries, and process documents efficiently. Robo-advisors use AI algorithms to deliver automated, tailored investment advice with minimal human intervention, making wealth management accessible to a broader audience. Additionally, robotic process automation (RPA) is used to handle repetitive back-office tasks, boosting accuracy and freeing human resources for strategic roles.

Examples of AI Applications in Banking, Investment, and Risk Management

AI applications are widespread across different finance sectors. In banking, AI is crucial for fraud detection by analysing transaction patterns and flagging anomalies in real time. Investment firms employ AI-driven algorithmic trading systems that execute trades based on complex market analysis. Risk management benefits from AI through predictive analytics that assess credit risk, market volatility, and compliance risks more accurately. AI-powered credit scoring models are improving lending decisions by incorporating alternative data sources for better borrower assessments. These examples illustrate how finance and artificial intelligence are converging to create smarter, more efficient financial ecosystems. The current landscape of financial technology demonstrates a profound shift toward intelligent, data-driven services that enhance efficiency, accuracy, and customer satisfaction.

What are the Top Finance and AI Trends to Watch in 2025?

As the intersection of finance and AI continues to evolve, several key trends are set to redefine the financial landscape in 2025. These innovations promise to enhance efficiency, security, and customer experience across the industry.

AI-Driven Predictive Analytics for Financial Forecasting

Predictive analytics powered by AI is becoming a cornerstone for financial forecasting. By analysing vast datasets and identifying patterns, AI models provide highly accurate predictions about market trends, asset performance, and economic shifts. This enables financial institutions to make informed strategic decisions, optimize investment portfolios, and better manage risks.

Increased Adoption of AI-Powered Chatbots and Virtual Assistants

Customer service in finance is experiencing a transformation with the rise of AI-powered chatbots and virtual assistants. These tools offer 24/7 support, handling routine inquiries, guiding users through transactions, and delivering personalized advice. Their ability to understand natural language and learn from interactions enhances customer satisfaction while reducing operational costs.

Integration of AI in Fraud Detection and Cybersecurity

With cyber threats growing more sophisticated, AI plays a critical role in strengthening fraud detection and cybersecurity measures. Machine learning algorithms continuously monitor transactions and network activities to detect anomalies and potential breaches in real-time. This proactive approach helps prevent financial fraud and protects sensitive customer data.

AI in Personalized Financial Planning and Wealth Management

AI-driven platforms are increasingly used for personalized financial planning and wealth management. By analysing individual financial behaviour, goals, and market conditions, AI can recommend tailored investment strategies and optimize asset allocation. This democratizes access to high-quality financial advice beyond traditional wealth management clients.

Expansion of AI for Regulatory Compliance and Reporting

Regulatory compliance remains a significant challenge for financial firms. AI is being deployed to automate compliance monitoring, reporting, and risk assessment processes. This reduces the risk of non-compliance, lowers costs, and ensures timely and accurate regulatory filings.

These trends illustrate how finance and artificial intelligence will continue to integrate deeply, driving innovation, efficiency, and resilience in the financial sector throughout 2025 and beyond.

How is Finance with AI Revolutionizing Decision-Making?

Data-Driven Insights Enhancing Financial Strategies

The fusion of advanced data analytics and artificial intelligence is transforming how financial decisions are made. By leveraging vast amounts of data, AI-driven tools provide deeper, more accurate insights that help organizations develop smarter financial strategies. These insights enable companies to forecast market trends, identify investment opportunities, and detect potential risks earlier than traditional methods. As a result, decision-makers can base their strategies on solid evidence, improving the overall effectiveness and agility of financial planning.

Automation of Routine Finance Tasks and Its Impact on Efficiency

One of the most significant impacts of AI on finance is the automation of repetitive and time-consuming tasks. Processes such as transaction processing, invoicing, reconciliation, and compliance checks can now be handled by AI-powered systems with minimal human intervention. This automation reduces errors, speeds up operations, and lowers operational costs. More importantly, it frees finance professionals to focus on higher-value activities such as strategy development and risk management, which require human judgment and creativity.

Case Studies Showcasing Improved Decision-Making Through AI

Across industries, companies are witnessing tangible benefits from incorporating AI into their finance functions. For instance, major banks have implemented AI-powered credit scoring models that improve loan approval accuracy while minimizing default risks. Investment firms use machine learning algorithms to optimize portfolio management, adjusting strategies dynamically based on real-time market data. Additionally, AI-driven dashboards provide CFOs with comprehensive, up-to-date financial metrics and scenario analyses, allowing for faster and more informed decisions.

Overall, the integration of finance with AI is revolutionizing decision-making by delivering actionable insights, automating routine tasks, and enabling more strategic, data-driven choices that drive business growth and resilience.

What are the Challenges and Ethical Considerations in Finance and AI?

Data Privacy and Security Concerns

As the use of AI in finance expands, data privacy and security have become critical challenges. Financial institutions handle vast amounts of sensitive personal and transactional data, making them prime targets for cyberattacks. Ensuring that AI systems securely manage and protect this information is paramount. Any breach or misuse of data can lead to severe financial losses and damage to customer trust. Therefore, organizations must implement robust cybersecurity measures and data governance frameworks to safeguard client information while leveraging AI technologies.

Bias in AI Algorithms Affecting Financial Outcomes

Another significant ethical concern in the use of artificial intelligence in finance is the potential bias embedded in AI algorithms. Since these models learn from historical data, any existing biases in the data can be perpetuated or even amplified, leading to unfair financial decisions. For example, biased credit scoring algorithms may disproportionately affect certain demographic groups, limiting their access to loans or financial products. Addressing algorithmic bias requires transparency in AI models, regular auditing, and diverse datasets to ensure fairness and equity in financial services.

Regulatory Challenges in AI Adoption Within Finance

The regulatory environment for AI in finance is still evolving, creating uncertainty for institutions seeking to adopt these technologies. Regulators must balance encouraging innovation with protecting consumers and maintaining market integrity. Compliance with existing financial regulations becomes more complex when AI systems make autonomous decisions. Additionally, new regulations specific to AI ethics, accountability, and transparency are emerging globally. Navigating this shifting regulatory landscape requires finance professionals to stay informed and collaborate with regulators to develop clear guidelines that support responsible AI adoption.

In summary, while finance and AI offer transformative potential, addressing data privacy, algorithmic bias, and regulatory challenges is essential to ensure ethical, secure, and fair implementation across the industry.

What’s Next for Finance and AI Beyond 2025?

Emerging AI Technologies on the Horizon

Looking beyond 2025, the finance industry is poised to benefit from groundbreaking AI technologies that promise to reshape its landscape. Quantum computing, for example, holds the potential to exponentially accelerate data processing and complex financial modelling, enabling institutions to solve problems previously deemed impossible. Similarly, advancements in Natural Language Processing (NLP) will allow AI systems to better understand and interpret human language, improving communication, sentiment analysis, and regulatory compliance. These emerging technologies will empower financial firms with unprecedented analytical power and operational efficiency.

Potential for AI to Disrupt Traditional Financial Roles

As AI capabilities evolve, traditional financial roles are expected to undergo significant transformation. Routine tasks like data entry, report generation, and basic analysis are increasingly automated, which could reduce demand for certain entry-level positions. However, this shift will also create new roles focused on managing AI systems, interpreting complex outputs, and applying strategic insights. Finance professionals will need to adapt by developing skills in AI oversight, data science, and ethical governance. The future workforce will likely be more tech-savvy and collaborative, blending human judgment with AI’s analytical strengths.

Predictions for AI-Driven Innovations in Global Finance Markets

AI-driven innovations are anticipated to drive greater personalization and real-time responsiveness in global finance markets. Enhanced predictive analytics will enable more accurate forecasting and risk assessment, helping investors and institutions make better-informed decisions. AI will also facilitate seamless cross-border transactions and compliance through automated monitoring of international regulations. Additionally, decentralized finance (DeFi) platforms powered by AI could revolutionize lending, asset management, and insurance by increasing transparency and accessibility. Overall, AI will accelerate financial inclusion and democratize access to sophisticated financial products worldwide.

In summary, the future of financial services beyond 2025 looks transformative, driven by emerging technologies and evolving professional roles. This progression is set to enhance efficiency, spark innovation, and promote greater inclusivity across the global financial ecosystem.

How Can Learning AI Boost your Career in Finance?

Importance of AI Skills for Finance Professionals

In today’s fast-evolving financial landscape, acquiring AI skills has become essential for finance professionals aiming to stay competitive. AI technologies are rapidly transforming how data is analysed, risks are managed, and decisions are made. Understanding AI enables finance experts to leverage predictive analytics, automate routine processes, and deliver more insightful financial strategies. Proficiency in AI not only enhances job performance but also opens doors to advanced roles such as quantitative analyst, AI-driven risk manager, and fintech innovator.

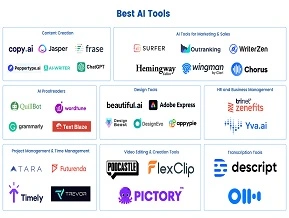

Overview of LAI’s AI Courses Tailored for Finance Industry Learners

LAI (Learn Artificial Intelligence) offers specialized AI courses designed specifically for finance professionals. These programs cover key topics such as machine learning for financial forecasting, natural language processing for market sentiment analysis, and AI-powered automation in accounting and compliance. LAI’s courses combine theoretical foundations with practical applications, helping learners build skills that directly translate to real-world finance scenarios. The flexible online format allows busy professionals to upskill at their own pace and apply knowledge immediately within their organizations.

Tips for Getting Started with AI in Finance

Starting with AI in finance requires a clear learning plan. Begin by understanding basic AI concepts and tools relevant to financial data analysis. Enrol in beginner-friendly courses, like those offered by LAI, to build foundational knowledge. Practice using AI-driven software and experiment with datasets to develop hands-on experience. Networking with professionals in AI and finance communities can provide valuable insights and support. Lastly, stay updated with the latest AI trends and continuously seek opportunities to apply AI techniques in your finance role.

By integrating AI skills into your professional toolkit, you can significantly boost your career prospects and contribute more effectively to your organization’s success in the digital age.

Conclusion

In conclusion, the landscape of finance with AI is rapidly evolving, with key trends like predictive analytics, AI-powered customer service, enhanced fraud detection, personalized financial planning, and regulatory automation shaping 2025. Embracing these advancements is essential for professionals to remain competitive and future-ready in the dynamic world of finance and AI. Investing in AI education not only sharpens your skills but also opens new career opportunities. To stay ahead of the curve, explore LAI’s comprehensive AI courses designed specifically for finance industry learners, and prepare yourself to thrive in the intelligent finance ecosystem of tomorrow.