Bookkeeping and AI: What you Need to Know Before Making the Switch?

What is Bookkeeping and AI — and Why Should you Care About the Shift?

Bookkeeping and AI is a game-changing combination that’s transforming how modern businesses manage their financial records. Traditional bookkeeping, once dependent on spreadsheets, manual data entry, and physical documentation, is now being reimagined through the lens of automation and artificial intelligence.

AI-driven tools are taking over repetitive and time-consuming tasks such as invoicing, expense tracking, bank reconciliation, and payroll processing. With smart algorithms, these systems can learn from historical data, detect anomalies, and even offer financial insights that were previously time-consuming to uncover. The result? Faster, more accurate bookkeeping with reduced risk of human error.

The impact of AI in the finance and accounting sector is already being felt across industries. From start-ups to large enterprises, companies are leveraging AI to streamline operations, cut costs, and gain real-time visibility into their financial health. This digital transformation isn't just a trend—it’s a shift that’s redefining roles, workflows, and decision-making in financial management.

That’s why understanding this evolution is essential before jumping into AI-powered bookkeeping systems. The switch involves more than just choosing a new software—it requires a mindset shift, process redesign, and sometimes, upskilling your team.

This guide is crafted for small business owners, freelancers, bookkeepers, and accounting students who are curious (or even cautious) about integrating AI into their financial operations. Whether you're looking to improve accuracy, save time, or gain smarter insights, this blog post will help you understand the benefits, challenges, and practical steps of making the switch.

Let’s examine the evolving landscape of automated financial management and its implications for your professional growth or business operations.

How is Bookkeeping and AI Creating a New Era of Financial Management?

Artificial Intelligence (AI) is revolutionizing industries, and bookkeeping is no exception. In the context of bookkeeping, AI refers to intelligent software that can analyse data, automate tasks, and provide real-time insights without constant human input. These tools go beyond traditional automation by learning from patterns and improving over time. When paired with bookkeeping systems, AI helps reduce human error, increase efficiency, and streamline complex financial processes.

The integration of bookkeeping and AI is not just about replacing human bookkeepers—it's about empowering them. AI allows professionals to shift their focus from repetitive tasks like data entry to more strategic roles such as financial analysis and advisory services.

How Modern Technologies Power AI Bookkeeping?

Modern automated accounting tools are powered by three core technologies:

- Machine Learning: Enables the system to learn from historical financial data and make predictions or detect anomalies, such as duplicate invoices or fraud.

- Automation: Handles routine processes like reconciling bank statements, categorizing expenses, and generating financial reports.

- Cloud Computing: Allows for real-time access, multi-user collaboration, and seamless integration with other business applications like payroll, tax software, or customer relationship management (CRM) tools.

Together, these technologies create a powerful ecosystem for modern financial management—one that’s faster, smarter, and more responsive to business needs.

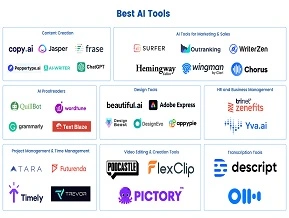

Popular AI-Powered Bookkeeping Software

Several cloud-based tools now offer AI features designed to simplify bookkeeping:

- QuickBooks Online – Uses AI to categorize expenses, automate transactions, and generate predictive reports.

- Xero – Offers automated bank feeds, smart reconciliation, and real-time cash flow insights.

- Zoho Books – Includes AI-driven reminders, smart dashboards, and automated workflows for recurring transactions.

As these tools become more advanced, businesses of all sizes are embracing this new wave of intelligent financial management.

What are the Key Benefits of AI Bookkeeping for Modern Businesses?

One of the biggest benefits of automated accounting is its ability to handle routine and time-consuming tasks automatically. Activities like invoice entry, bank reconciliation, payroll processing, and expense categorization—once done manually—can now be handled by intelligent systems in minutes. This automation frees up valuable time for business owners and accountants to focus on growth and strategic planning.

Reduce Human Errors in Financial Data

Manual bookkeeping is prone to mistakes—missed entries, miscalculations, or duplication errors. AI-driven tools minimize these risks by automatically checking, categorizing, and validating financial data. With built-in accuracy checks, businesses can rely on more consistent and error-free reporting, which is essential during audits or tax season.

Gain Real-Time Financial Insights and Forecasting

AI doesn’t just automate; it analyses. These smart tools provide real-time dashboards and reports that give a clear picture of a company’s financial health. With forecasting features, businesses can predict cash flow, identify seasonal trends, and make data-backed decisions to stay ahead. This forward-looking approach helps in planning budgets, securing funding, and managing risk effectively.

Seamless Integration with Business Tools

Contemporary AI-powered accounting systems are built to seamlessly connect with platforms like CRMs, payroll solutions, banking services, and tax compliance tools. This centralization improves workflow efficiency and ensures all financial data stays synchronized and up to date across systems.

Case Study: Before and After AI Bookkeeping

A local retail business spent over 15 hours a week on manual bookkeeping tasks. After implementing an AI bookkeeping solution, they reduced that time to just 3 hours. Not only did they cut down on operational costs, but they also identified spending inefficiencies through AI-generated reports—leading to a 12% increase in profit margins within six months.

What are the Challenges and Limitations of AI Bookkeeping?

Although automated accounting solutions offer significant advantages, they also come with certain challenges. Understanding these limitations is essential for businesses to make an informed decision when adopting new technologies.

Data Privacy and Cybersecurity Concerns

One of the primary concerns with AI-driven financial tools is data security. Automated bookkeeping systems manage sensitive data such as bank account information, payroll details, and financial statements. If not properly secured, this data can become vulnerable to cyberattacks or breaches. Businesses must ensure that any AI solution they adopt complies with global data protection standards (like GDPR) and offers robust encryption, access controls, and regular security updates.

Cost of Implementation and Software Subscriptions

Adopting AI-powered bookkeeping solutions typically requires an initial investment. Subscription fees, onboarding charges, staff training, and integration expenses can be significant—especially for small businesses or start-ups operating on tight budgets. Although these tools often lead to long-term savings, the initial investment can be a barrier for many organizations.

Limited Customization for Complex Accounting Needs

Many AI-powered bookkeeping platforms are designed for standard financial processes and may lack the customization required by businesses with complex or specialized accounting needs. Industries like construction, healthcare, or non profit organizations may find that generic tools lack specific features tailored to their compliance or reporting requirements.

Dependence on Software Providers

Using AI bookkeeping means relying on third-party providers for updates, bug fixes, and regulatory compliance. If the provider experiences downtime, discontinues the software, or fails to stay current with tax regulations, your business could face operational and legal issues. This dependence can limit flexibility and control, especially for businesses in rapidly evolving industries.

Despite these obstacles, proactively recognizing and managing them enables businesses to adopt automated accounting solutions securely and efficiently.

What Do you Need to Know Before Switching to AI Bookkeeping?

Before diving into automation, it’s important to prepare your business for the transition. Implementing intelligent bookkeeping solutions successfully requires strategy, planning, and a clear understanding of your current financial workflows.

Evaluate your Current Bookkeeping System

Start by reviewing your existing bookkeeping setup. What tools are you using? Are your processes manual, semi-automated, or already digital? Identify areas where inefficiencies exist—such as delays in invoicing, manual bank reconciliations, or difficulty tracking expenses. This will help you determine whether an AI-powered solution is the right fit.

Pinpoint Tasks That Can Be Automated

Not all financial tasks need AI. Focus on repetitive, time-consuming tasks like expense categorization, invoice management, payroll processing, and monthly reconciliations. These are prime candidates for automation and can save hours of manual effort.

Set Clear Goals for the Transition

Define what you hope to achieve with AI-driven tools. Are you looking to reduce administrative costs? Improve accuracy? Gain real-time financial insights? Your goals—whether operational efficiency, compliance, or strategic forecasting—should guide your choice of software and implementation plan.

Assess Team Readiness and Training Needs

Technology is only as effective as the people using it. Gauge your team’s comfort with digital tools. Do they need training on new software? Are there any concerns about job security or role changes? Preparing your staff with clear communication and upskilling will ensure smoother adoption.

Choose the Right AI Bookkeeping Tool

When selecting a platform, consider features, pricing, integrations, customer support, and scalability. Compare top options like QuickBooks Online, Xero, and Zoho Books. Look for tools that align with your business goals and can grow with you over time. Making the right decision starts with understanding the core needs of your business and matching them with the capabilities of AI bookkeeping solutions.

How Can you Transition from Manual Bookkeeping to AI-Powered Systems?

Making the switch from manual bookkeeping to AI-powered systems can seem daunting, but with a clear plan, it becomes manageable and rewarding. Here’s a step-by-step guide to help you through the process.

Step 1: Conduct a Bookkeeping Audit

Begin by auditing your current bookkeeping processes. Identify what data you have, how it’s organized, and where inefficiencies exist. This audit will form the foundation for selecting the right AI tools and planning a smooth transition.

Step 2: Select the Right AI Tool

Based on your audit and business needs, research and choose an automated accounting solution that fits your size, industry, and goals. Consider features like automation capabilities, integrations, user-friendliness, and customer support.

Step 3: Migrate Your Data Carefully

Data migration is a critical step. Export your existing financial records and import them into the new system. Ensure data accuracy and completeness to avoid issues later. It’s advisable to keep backups of all original files before and after migration.

Step 4: Test the New System

Before fully committing, run tests on the automated accounting platform.

Verify that transactions are recorded correctly, reports generate as expected, and automated processes function smoothly. This phase helps identify glitches and adjustments needed.

Step 5: Train Your Team

Educate your team on how to use the new system effectively. Provide training sessions, tutorials, and support resources. A well-prepared team will adapt faster and maximize the benefits of automation.

Timeline Estimation and Planning

Typically, transitioning can take anywhere from a few weeks to a couple of months depending on business size and complexity. Planning realistic timelines ensures minimal disruption.

Data Backup and Disaster Recovery

Establish a data backup strategy and disaster recovery plan. Regularly back up financial data to prevent loss in case of technical failures or cyber threats.

Monitor Success and Optimize

Track key performance indicators (KPIs) such as time saved, error reduction, and financial reporting accuracy. Use these insights to continually optimize your bookkeeping processes.

By following these steps, businesses can smoothly adopt bookkeeping and AI systems and unlock greater efficiency and insight in financial management.

Conclusion

In conclusion, the integration of bookkeeping and AI is transforming how businesses manage their finances—offering automation, accuracy, and real-time insights. Embracing this technological shift proactively can give your business a competitive edge. However, successful adoption of ai bookkeeping requires more than just software; it demands the right knowledge, careful planning, and a mindset open to change. By understanding the benefits and challenges, and preparing your team accordingly, you can make a smooth transition that boosts efficiency and supports long-term growth. Stay informed and ready to adapt as the future of bookkeeping evolves.