Beginner’s Guide to Artificial Intelligence and Financial Services

What are the Key Applications of Artificial Intelligence for Financial Services?

Artificial Intelligence for Financial Services is revolutionizing how institutions operate, manage risk, and engage with customers. From fraud detection to personalized banking experiences, AI is enabling smarter, faster, and more efficient financial services.

Fraud Detection and Prevention Using AI Algorithms

AI algorithms play a crucial role in detecting and preventing fraudulent activities in real time. By analysing vast amounts of transactional data and identifying unusual patterns, AI systems can flag potential fraud faster than traditional methods. This reduces financial losses and helps maintain customer trust.

Credit Risk Assessment and Underwriting Automation

Financial institutions are leveraging AI to automate credit scoring and loan underwriting. Machine learning models analyse diverse data points—beyond traditional credit reports—to assess a borrower’s risk more accurately. This leads to faster approvals and more inclusive lending decisions, especially for underbanked populations.

AI-Driven Algorithmic Trading and Portfolio Management

AI is transforming investment strategies through algorithmic trading and robo-advisory platforms. These systems process market data at high speeds, identify trading opportunities, and make split-second decisions to optimize returns. Portfolio management powered by AI can dynamically adjust investment allocations based on real-time market trends and client preferences.

Customer Experience Enhancement through AI Chatbots and Virtual Assistants

AI chatbots and virtual assistants enhance customer service by offering instant, 24/7 support. They handle routine queries, assist with transactions, and even provide financial advice. This improves customer satisfaction while reducing operational costs.

Regulatory Compliance and Anti-Money Laundering (AML) Processes Powered by AI

Artificial Intelligence and Financial Services are also converging in regulatory compliance. AI tools can monitor transactions, detect anomalies, and ensure institutions meet AML requirements more efficiently than manual methods.

In summary, the integration of Artificial Intelligence for Financial Services is reshaping the industry, offering innovative solutions to age-old challenges and paving the way for a more efficient, secure, and customer-centric financial future.

How Artificial Intelligence and Financial Services Collaborate to Drive Innovation?

Artificial Intelligence and Financial Services are increasingly working together to revolutionize the industry through innovation, efficiency, and personalization. AI is helping financial institutions move from traditional operations to intelligent, data-driven ecosystems that better serve both businesses and customers.

Automation of Routine Financial Processes for Efficiency

One of the most immediate impacts of AI in finance is the automation of repetitive and time-consuming tasks. From data entry and transaction processing to compliance reporting and reconciliation, AI-driven systems can handle these processes quickly and accurately. This frees up human employees for higher-value work and significantly increases operational efficiency.

Real-Time Data Analytics and Insights for Decision Making

Financial institutions rely heavily on data to guide decision-making. AI enhances this by processing large datasets in real time, detecting patterns, and generating actionable insights. This allows banks and investment firms to react more swiftly to market changes, improve risk management, and optimize product offerings.

Personalized Financial Products and Advisory Services Enabled by AI

Artificial Intelligence for Financial Services enables a new level of personalization. AI algorithms analyse customer behaviour, preferences, and financial goals to offer tailored products, investment advice, and budgeting tools. This leads to improved customer satisfaction and loyalty while helping users make smarter financial decisions.

Cost Reduction and Operational Risk Management through AI Integration

AI helps reduce costs by minimizing errors, automating manual processes, and improving system efficiencies. Additionally, AI plays a key role in identifying and mitigating operational risks by predicting system failures, detecting fraud, and ensuring compliance.

In conclusion, the collaboration between these are driving innovation that benefits both institutions and consumers. As AI technology continues to advance, it will further reshape the financial landscape with smarter, faster, and more adaptive solutions.

What are the Real-World Case Studies of AI in Financial Services?

AI in Financial Services is no longer a futuristic concept—it's a practical tool delivering measurable value across banking, insurance, and fintech. These real-world case studies highlight how organizations are using AI to drive efficiency, reduce risk, and enhance customer experience.

Examples of Successful AI Implementation in Banking, Insurance, and Fintech

Banks like JPMorgan Chase have adopted AI for contract analysis through their COIN platform, reducing the review time for legal documents from 360,000 hours annually to just seconds. In insurance, Lemonade uses AI bots for claim processing, providing near-instant responses and pay-outs. Fintech companies like Upstart utilize AI-driven models for credit underwriting, enabling more accurate and inclusive lending decisions.

Measurable Business Outcomes from AI Adoption

The adoption of AI in Financial Services has resulted in significant improvements in operational performance. For example, banks implementing AI-powered fraud detection systems have reported a 30–50% reduction in fraudulent activity. Robo-advisory platforms have reduced the cost of investment management while increasing access to financial planning for broader audiences. Additionally, customer service chatbots have improved response times by 80% and reduced support costs dramatically.

Insights and Lessons Learned from Industry Leaders Leveraging AI

Industry leaders emphasize the importance of a clear data strategy, cross-functional collaboration, and ethical AI use. Successful implementations often start with small pilot projects, followed by scaling AI solutions across the enterprise. Transparency, explain ability, and compliance are also critical in building trust with customers and regulators.

In summary, these case studies demonstrate that AI in Financial Services is not only technically feasible but also economically advantageous. Institutions embracing AI are gaining a competitive edge, making smarter decisions, and reshaping the future of financial services.

What are the Benefits of Adopting Artificial Intelligence for Financial Services Institutions?

Adopting Artificial Intelligence for Financial Services Institutions is rapidly becoming essential as the industry evolves. AI enables organizations to enhance operational efficiency, security, and customer engagement—while positioning themselves as leaders in innovation.

Increased Accuracy and Reduction of Manual Errors

One of the key benefits of AI adoption is improved accuracy in data handling and processing. Tasks like transaction monitoring, document verification, and report generation, which are prone to human error, are executed flawlessly by AI systems. This leads to more reliable operations and minimizes costly mistakes.

Enhanced Security Measures and Fraud Mitigation

AI-powered tools significantly strengthen security protocols. Machine learning algorithms analyse transaction patterns in real time to detect and prevent fraudulent activities. Many financial institutions now use AI for identity verification, anomaly detection, and threat prediction—reducing both internal and external risks.

Improved Customer Satisfaction and Retention

Artificial Intelligence enhances customer experience through personalized services and faster response times. Chatbots and virtual assistants offer 24/7 support, while AI-driven analytics provide tailored product recommendations based on user behaviour. These improvements not only boost customer satisfaction but also foster long-term loyalty and retention.

Gaining Competitive Advantage through AI Innovation

Institutions that implement AI effectively gain a clear edge in the competitive financial landscape. From faster loan approvals to smarter investment strategies, AI helps institutions deliver superior services. Furthermore, embracing AI showcases a forward-thinking approach, attracting both customers and investors.

In summary, adopting Artificial Intelligence for Financial Services Institutions offers tangible benefits—from operational efficiency to customer engagement and market competitiveness. As the financial industry becomes increasingly digital, leveraging AI is no longer optional—it’s a strategic imperative for sustainable growth.

What are the Challenges and Ethical Considerations in Artificial Intelligence and Financial Services?

Artificial Intelligence and Financial Services are deeply intertwined, offering innovation and efficiency—but also raising important challenges and ethical questions. As institutions adopt AI technologies, they must navigate issues related to fairness, integration, and compliance to ensure responsible and effective implementation.

Data Privacy, Security, and Ethical Use of AI

One of the foremost concerns in AI deployment is the handling of sensitive financial and personal data. Financial institutions must ensure that AI systems uphold strict data privacy standards and that customer information is protected from unauthorized access or breaches. Ethical considerations also involve transparency in how data is used and decisions are made, especially when algorithms influence financial outcomes.

Managing Biases and Fairness in AI Models

Bias in AI models is a major concern, particularly when it leads to discriminatory outcomes in credit scoring, loan approvals, or fraud detection. If training data reflects historical inequalities, the AI may reinforce them. Financial services firms must actively monitor, audit, and retrain AI models to ensure fairness and avoid unintentionally marginalizing certain groups.

Integration Challenges with Existing Legacy Systems

Integrating AI into outdated or siloed financial infrastructures presents technical difficulties. Legacy systems may lack the flexibility or connectivity to support modern AI solutions. Upgrading systems or building middleware interfaces can be time-consuming and expensive, requiring careful planning and investment.

Navigating Regulatory and Compliance Requirements

Compliance is another key challenge in Artificial Intelligence and Financial Services. Regulators are increasingly scrutinizing how AI decisions are made, especially in areas like anti-money laundering (AML) and risk assessment. Financial institutions must ensure that their AI systems are explainable, auditable, and aligned with evolving legal standards.

In conclusion, while AI offers transformative potential, financial institutions must address these challenges thoughtfully to ensure ethical and sustainable adoption.

What are the Emerging Trends in Artificial Intelligence for Financial Services?

AI for Financial Services is evolving rapidly, introducing new capabilities that are reshaping how financial institutions operate, interact with customers, and manage risk. Several key trends are driving this transformation and will continue to shape the future of the financial sector.

The Rise of Explainable AI (XAI) for Transparency and Trust

As AI becomes more integral to decision-making in finance, the demand for transparency has increased. Explainable AI (XAI) is gaining traction as it allows institutions to understand and interpret how AI models arrive at specific decisions. This is especially important in highly regulated sectors like banking and insurance, where explain ability builds trust with both regulators and customers, ensuring that decisions are fair, auditable, and unbiased.

Expansion of AI in Blockchain and Cryptocurrency Applications

The intersection of AI and blockchain technology presents exciting possibilities. AI is being used to analyse blockchain data for market trends, fraud detection, and predictive modelling in cryptocurrency trading. In decentralized finance (DeFi), AI can automate smart contract auditing, risk scoring, and compliance monitoring, increasing security and efficiency in digital asset management.

AI-Powered Robo-Advisors and Personalized Investment Solutions

Artificial Intelligence for Financial Services is also driving a new wave of personalized financial products. AI-powered robo-advisors provide tailored investment recommendations based on a user’s financial goals, behaviour, and risk tolerance. These platforms are making wealth management accessible to a broader audience, offering low-cost, data-driven guidance that adapts in real time to market changes and client needs.

How Can You Get Started with Artificial Intelligence for Financial Services Through Skills and Learning Pathways?

Artificial Intelligence for Financial Services is transforming the industry, and finance professionals need to build relevant skills to stay competitive. Understanding AI’s fundamentals and applying them effectively can open new career opportunities and drive innovation within organizations.

Essential AI Skills and Knowledge Areas for Finance Professionals

Finance experts should develop a solid foundation in AI concepts such as machine learning, natural language processing (NLP), and data analytics. Familiarity with programming languages like Python and tools like TensorFlow or scikit-learn is beneficial. Additionally, understanding how AI integrates with financial processes—such as risk assessment, fraud detection, and algorithmic trading—is critical for practical application.

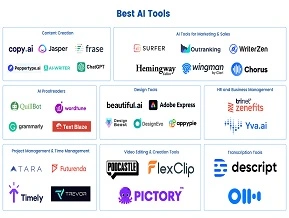

Recommended Online Courses and Certifications in AI and Finance

Many online platforms offer specialized courses that blend AI with financial services. Courses like "AI for Everyone" by Andrew Ng on Coursera provide accessible introductions, while certifications such as the Certified Artificial Intelligence Practitioner (CAIP) focus on practical AI skills. Platforms like edX, Udacity, and LinkedIn Learning also offer finance-specific AI courses, enabling professionals to tailor their learning paths.

The Importance of Continuous Learning and Staying Updated with AI Advancements

Given the rapid pace of AI development, continuous education is essential. Professionals should follow industry news, attend webinars, participate in workshops, and engage with AI-focused communities. Staying updated ensures that finance professionals can adapt to new tools, regulatory changes, and emerging AI applications in the sector.

Conclusion

Artificial Intelligence is transforming financial services, driving efficiency, security, and personalized experiences. Its impact is reshaping how institutions operate and compete in a rapidly evolving market. To stay ahead, professionals must embrace AI education and training opportunities, such as those offered by LAI, to develop essential skills. Looking ahead, the intersection of AI and finance promises continued innovation, unlocking smarter solutions and improved decision-making. By committing to lifelong learning and AI adoption, the financial industry can build a smarter, more resilient future that benefits organizations and customers alike.