AI in Finance Industry: How Artificial Intelligence is Disrupting Traditional Banking?

Understanding AI in Finance Industry

AI in finance industry is transforming the way financial services are delivered, offering smarter, faster, and more secure solutions across the entire banking ecosystem. As financial institutions strive to remain competitive in a rapidly evolving digital landscape, artificial intelligence is emerging as a key driver of innovation and efficiency.

Definition of AI and Its Core Technologies

Artificial Intelligence (AI) is the ability of machines to perform tasks that typically require human intelligence. In the finance sector, this encompasses several core technologies:

- Machine Learning (ML): Enables systems to learn from data and improve over time without being explicitly programmed.

- Natural Language Processing (NLP): Allows machines to understand and interact using human language, enhancing customer service through chatbots and virtual assistants.

- Robotic Process Automation (RPA): Automates repetitive tasks such as data entry and compliance reporting.

- Computer Vision and Predictive Analytics: Used for identity verification and forecasting market trends.

These technologies help banks and financial firms deliver personalised experiences, detect fraud, assess credit risk, and manage operations more effectively.

Role of AI in the Broader Financial Ecosystem

AI enhances every aspect of the financial services value chain—from customer on boarding to portfolio management. It supports real-time decision-making, automates regulatory compliance, and helps firms uncover insights hidden in massive data sets. AI also plays a pivotal role in fintech innovations, bridging gaps between traditional banks and tech-driven start-ups.

Historical Context: From Automation to Intelligence

The ai and finance industry relationship began with simple automation tools to reduce human effort in repetitive tasks. Over time, it evolved into intelligent systems capable of learning, adapting, and making complex decisions. Today, AI is not just supporting finance—it’s redefining it by enabling smarter banking services and transforming customer expectations.

Applications of AI in Finance Industry

The integration of AI in finance industry has led to revolutionary applications across banking and financial services. From fraud prevention to investment management, AI technologies are improving accuracy, reducing risks, and enhancing customer experiences.

a. AI in Fraud Detection and Prevention

AI systems use real-time data analysis and behavioural pattern recognition to detect fraudulent transactions. Unlike traditional rule-based systems that rely on fixed criteria, AI can adapt to evolving fraud tactics. It flags anomalies instantly, minimising financial losses and boosting customer trust.

b. AI-Powered Credit Scoring and Risk Assessment

AI evaluates creditworthiness using both traditional and alternative data, such as social behaviour, transaction history, and mobile usage. This leads to more accurate and inclusive credit assessments. AI also reduces human bias by relying on data-driven insights, ensuring fairer lending decisions.

c. Chatbots and Virtual Assistants in Banking

AI-powered chatbots offer 24/7 customer support, handling queries, providing account information, and even guiding users through financial products. They reduce wait times and operational costs while improving customer satisfaction. Examples include AI assistants in mobile banking apps that respond in natural language.

d. Algorithmic Trading and Investment Management

In trading, AI analyses vast amounts of market data to make high-speed decisions, essential for high-frequency trading. Robo-advisors use AI to build and manage personalised investment portfolios based on user goals and risk tolerance, making wealth management more accessible.

e. AI in Regulatory Compliance (RegTech)

AI automates compliance tasks by continuously monitoring transactions and identifying potential regulatory breaches. It helps institutions keep up with changing regulations, reduces the burden on compliance teams, and ensures timely reporting.

Overall, the strategic use of AI in finance industry is driving greater efficiency, accuracy, and innovation across financial services.

How are AI and the Finance Industry Evolving Together?

The evolution of AI in finance industry marks a transformative shift from conventional banking methods to intelligent, data-driven operations. As the financial sector embraces innovation, both established institutions and fintech start-ups are reimagining how financial services are delivered.

Shift from Traditional Banking to AI-First Models

Traditional banks are moving away from paper-based, manual systems to AI-first models that prioritise automation, speed, and data insights. AI enhances customer experience through personalisation, predictive analytics, and 24/7 support, while backend operations become more efficient with automated decision-making and intelligent workflows. This AI-first approach not only improves productivity but also enables banks to scale services without proportionally increasing costs.

Collaboration between Fintech Start-ups and Legacy Banks

Fintech start-ups are leading the way in developing agile AI solutions, while legacy banks bring in regulatory experience, customer trust, and vast datasets. By collaborating, both parties benefit—start-ups gain market access and credibility, while traditional banks accelerate their innovation without building everything from scratch. These partnerships often result in AI-powered apps, robo-advisory platforms, and intelligent loan processing tools.

Case Studies: Successful AI Implementation in Banking

- JPMorgan Chase uses AI to review legal documents through its COiN platform, saving thousands of hours of manual work.

- HSBC leverages AI for fraud detection and customer engagement using predictive analytics and intelligent virtual assistants.

- BBVA has integrated AI in its mobile banking platform to offer real-time financial advice and automate routine transactions.

These examples highlight how the ai in finance industry is enabling banks to deliver faster, safer, and more personalised services. As AI technologies continue to mature, the collaboration between AI systems and financial institutions will define the next era of banking innovation.

Benefits of AI in Finance Industry

The adoption of AI in finance industry brings a wide array of advantages that enhance both operational capabilities and customer experiences. Financial institutions are leveraging AI to streamline processes, make smarter decisions, and stay ahead in a competitive market.

Improved Efficiency and Cost Reduction

AI automates repetitive and time-consuming tasks such as data entry, transaction monitoring, and report generation. This leads to faster processing times, fewer errors, and significant cost savings. Robotic Process Automation (RPA) in particular helps banks handle high-volume tasks without expanding staff, allowing human resources to focus on more strategic roles.

Enhanced Decision-Making and Personalisation

AI systems analyse large volumes of structured and unstructured data in real time, providing insights that support smarter, data-driven decisions. From investment strategies to loan approvals, AI models consider numerous variables to optimise outcomes. Moreover, AI enables hyper-personalisation by tailoring financial products, offers, and advice based on individual customer behaviour and preferences.

Better Customer Engagement and Satisfaction

AI-powered chatbots and virtual assistants offer 24/7 support, resolving customer queries instantly and efficiently. This not only improves customer satisfaction but also reduces the burden on human customer service teams. Predictive analytics further enhances engagement by anticipating customer needs, sending timely alerts, and offering proactive solutions.

In summary, the ai in finance industry enables institutions to operate more efficiently, make better decisions, and connect with customers on a deeper level—ultimately fostering trust and driving long-term growth in the financial sector.

Challenges and Ethical Considerations

While the rise of AI in finance industry brings significant benefits, it also introduces a range of challenges and ethical concerns. Financial institutions must navigate these issues carefully to ensure AI is deployed responsibly and fairly.

Data Privacy and Security Concerns

AI systems rely heavily on large volumes of personal and financial data to function effectively. This raises serious concerns around data privacy, especially when sensitive customer information is involved. Ensuring robust cybersecurity, secure data storage, and compliance with data protection laws like the UK GDPR or the EU’s AI Act is critical. A breach or misuse of data can severely damage a company’s reputation and trustworthiness.

Bias and Fairness in AI Algorithms

AI models can unintentionally reinforce biases present in historical data, leading to unfair outcomes—particularly in credit scoring, lending, and fraud detection. If not properly designed and monitored, these models can discriminate against certain demographics. Addressing bias requires diverse training data, transparent modelling processes, and ongoing auditing to ensure fairness and accountability.

Regulatory and Governance Hurdles

The fast pace of AI development often outpaces regulatory frameworks. Financial institutions must stay up to date with evolving rules around AI deployment, model explain ability, and consumer protection. Regulators are increasingly demanding transparency, especially in high-stakes applications such as algorithmic lending or compliance monitoring. Establishing internal governance structures to oversee ethical AI use is essential.

In short, while ai in finance industry is transforming services, responsible implementation is vital to mitigate risks. By prioritising ethics, fairness, and compliance, institutions can build trust and create long-term value through AI.

The Future of AI and Finance Industry

The future of AI and finance industry is set to be shaped by rapid innovation, smarter automation, and deeper integration of AI across all financial services. As technologies evolve, the sector is expected to undergo a profound transformation over the next 5–10 years.

Predictions for the Next 5–10 Years

In the coming decade, AI is predicted to play an even more central role in decision-making, customer interaction, fraud prevention, and portfolio management. Hyper-personalised financial services powered by real-time data and predictive analytics will become the norm. AI-driven automation will streamline everything from regulatory compliance to wealth management, dramatically reducing costs and improving accuracy.

Role of AI in Digital Banks and DeFi

AI will be pivotal in the rise of digital-only banks, offering seamless, intelligent banking experiences without the need for physical branches. These AI-powered institutions will rely on algorithms for credit decisions, investment advice, and risk assessments. In decentralised finance (DeFi), AI will enhance smart contract performance, predict market trends, and help manage risks in real-time—pushing the boundaries of traditional financial models.

Importance of AI Literacy for Finance Professionals

As AI becomes embedded in everyday financial operations, finance professionals must develop strong AI literacy. Understanding how algorithms work, interpreting AI-generated insights, and recognising ethical and regulatory implications will be crucial skills. Continuous learning through courses and training will empower professionals to work effectively alongside AI and leverage its capabilities responsibly.

In essence, the AI and finance industry are evolving together to build a more agile, intelligent, and inclusive financial ecosystem. Preparing for this future means embracing technology while upholding transparency, fairness, and human oversight in all AI-driven decisions.

How Can You Learn About AI in the Finance Industry?

Understanding how AI and finance industry are converging is crucial for professionals seeking to remain relevant in an evolving digital economy. With artificial intelligence transforming everything from investment decisions to compliance and customer service, building AI literacy is no longer a luxury—it’s a necessity.

Importance of AI Education in the Finance Sector

The integration of AI in finance is reshaping job roles, workflows, and business models. Financial professionals must grasp core AI concepts—such as machine learning, natural language processing, and data analytics—to interpret AI-driven insights and contribute to digital transformation strategies. AI education empowers professionals to make data-informed decisions, automate manual processes, and improve customer experiences, ultimately boosting organisational efficiency and competitiveness.

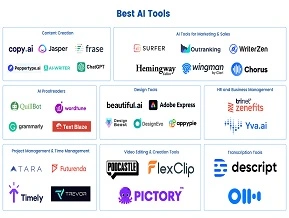

Overview of Relevant AI Courses Offered by LAI (Learn Artificial Intelligence)

At LAI (Learn Artificial Intelligence), learners can choose from a variety of AI courses designed specifically for the financial sector. These include:

- AI for Financial Services – Covers foundational AI concepts applied in banking and finance.

- Machine Learning for Risk and Credit Analysis – Focuses on predictive models used for credit scoring and fraud prevention.

- Algorithmic Trading and Robo-Advisory – Teaches how AI powers trading platforms and investment management.

- RegTech: AI for Compliance and Regulation – Explores the use of AI to streamline compliance and reduce regulatory risk.

All courses are delivered online, allowing flexible learning for professionals and students worldwide.

Recommended Learning Paths for Finance Professionals and Students

Beginners should start with a general AI fundamentals course, followed by industry-specific training in AI for Finance. Mid-career professionals may explore advanced modules like algorithmic trading or RegTech, while students can build a strong foundation to future-proof their careers. As ai and finance industry continue to intertwine, up skilling ensures you remain agile, innovative, and in demand.

Conclusion

The ai in finance industry is undeniably reshaping traditional banking, driving greater efficiency, smarter decision-making, and improved customer experiences. As AI technologies continue to evolve, financial institutions must embrace this change to stay competitive and innovative. The fusion of ai and finance industry opens exciting opportunities for professionals willing to adapt and learn. To future-proof your career and stay ahead in this fast-moving landscape, explore the comprehensive AI courses offered by LAI (Learn Artificial Intelligence). Start your AI learning journey today and be part of the next wave of financial innovation.