How AI in Finance & Accounting is Transforming Business Operations in 2025?

What is AI in Finance & Accounting?

AI in Finance & Accounting refers to the use of artificial intelligence technologies to streamline, automate, and enhance financial and accounting operations. These technologies help businesses manage large volumes of data, reduce manual errors, improve decision-making, and boost operational efficiency. AI is increasingly being used across financial sectors, from auditing and bookkeeping to fraud detection and financial planning.

Key AI Technologies Used

Several advanced technologies power AI in finance and accounting:

- Machine Learning (ML): Enables systems to learn from historical financial data and improve over time without being explicitly programmed. It's used for predictive analytics, credit scoring, and risk management.

- Natural Language Processing (NLP): Allows AI systems to understand and interpret human language, making it possible to analyse financial reports, contracts, and customer communications quickly and accurately.

- Robotic Process Automation (RPA): Automates repetitive and rule-based tasks such as invoice processing, data entry, and reconciliation, significantly reducing human workload.

- Generative AI: Capable of generating text, summaries, or reports, this AI helps accountants and finance teams’ draft narratives or simulate financial scenarios based on existing data.

Core Functions in Finance and Accounting Where AI is Applied

AI is transforming many core areas of finance and accounting, including:

- Auditing and Compliance: AI helps detect anomalies and potential fraud through real-time monitoring and pattern recognition.

- Forecasting and Budgeting: Machine learning models can accurately predict future trends using historical data, aiding in strategic planning.

- Accounts Payable and Receivable: Automation tools streamline invoicing, payments, and collections.

- Tax Preparation and Filing: AI systems can organize and analyse financial data to ensure accurate tax calculations and compliance.

By integrating AI into these core functions, organizations can achieve greater accuracy, cost savings, and strategic agility in today’s fast-paced financial environment.

What are the Benefits of AI in Finance & Accounting for Business Operations?

Artificial Intelligence (AI) is driving a major transformation in Accounting and Finance, reshaping how businesses manage their financial operations. Here are the key benefits AI brings to the table in 2025:

Increased Efficiency and Automation

AI automates repetitive and time-consuming tasks such as data entry, invoice processing, and bank reconciliations. Robotic Process Automation (RPA) tools powered by AI can handle thousands of transactions in seconds—reducing human error and freeing finance professionals to focus on strategy and analysis. This automation drastically improves operational speed and productivity.

Real-Time Data Analysis and Reporting

AI systems can analyse vast volumes of financial data in real-time, providing businesses with immediate insights. Predictive analytics helps finance teams forecast trends, manage cash flow, and make informed decisions faster than ever before. Dashboards powered by AI offer up-to-the-minute reports, enabling quick responses to market changes.

Enhanced Accuracy and Fraud Detection

AI algorithms detect anomalies and patterns that may indicate fraud or financial misstatements. By continuously monitoring transactions, AI reduces the risk of financial fraud and ensures compliance with industry regulations. Machine learning models also improve accuracy over time, minimizing manual errors in accounting records.

Cost Savings and Scalability

Implementing AI in finance operations leads to significant cost reductions. Automation reduces the need for large teams to manage routine tasks, and cloud-based AI tools scale easily as businesses grow. Whether a start-up or a global enterprise, AI offers flexible solutions that align with a company’s evolving financial needs.

AI is no longer optional—it's essential for businesses aiming to modernize their Accounting and Finance functions and stay competitive in 2025 and beyond.

How is AI Transforming Real-World Finance & Accounting?

Real-World Examples from 2025

In 2025, several companies across industries are leveraging AI transformations in real-world Accounting and Finance to gain a competitive edge. For instance, a global retail giant implemented AI-powered forecasting tools that analyse past sales data, economic indicators, and consumer trends to predict revenue. This helped the company optimize inventory and reduce costs by 18%.

Another example is a multinational financial services firm that integrated robotic process automation (RPA) into its accounts payable system. The AI bots now handle invoice processing, matching, and payments, reducing processing time by over 60% and virtually eliminating human errors.

A large auditing firm adopted natural language processing (NLP) tools to analyse complex legal and financial documents quickly. This reduced manual review time by 40%, allowing auditors to focus on higher-level analysis and strategic decision-making.

Impact on Operational Performance and Decision-Making

These AI-driven solutions are not just about efficiency—they are also improving the quality of decision-making. AI enables real-time access to financial data, allowing leaders to make informed choices quickly.

For example, a tech company used machine learning to assess the financial risk of new investments based on market trends and historical data. This reduced their exposure to underperforming assets and improved ROI by 15%.

In accounting departments, AI tools are enhancing compliance and transparency by automatically flagging unusual transactions or inconsistencies in financial statements. As a result, businesses are seeing reduced audit risks and improved stakeholder confidence.

These case studies show that AI is no longer a future trend but a practical tool transforming how financial operations are managed, offering real-world value in terms of accuracy, speed, and insight.

What are the Challenges of Using AI in Finance & Accounting?

Data Privacy and Security Concerns

One of the most pressing challenges of using AI in finance & accounting is safeguarding sensitive financial data. AI systems process vast amounts of confidential information, including transactions, payroll, and customer records. If not properly secured, these systems become potential targets for cyberattacks and data breaches. Ensuring robust encryption, secure access protocols, and continuous monitoring is essential to maintain trust and protect against threats.

Regulatory and Compliance Challenges

The financial sector is one of the most heavily regulated industries. As AI solutions evolve, regulatory frameworks often struggle to keep up. Compliance with laws such as GDPR, SOX, and other financial reporting standards becomes more complex when AI-driven automation is involved. Businesses must ensure that AI models are transparent, auditable, and aligned with evolving legal requirements, which can be both time-consuming and costly.

Skills Gap and Workforce Adaptation

Adopting AI requires a workforce that understands both financial principles and advanced technologies. However, there is a noticeable skills gap in many organizations. Finance professionals may lack the technical expertise to work with AI tools, while data scientists might not fully grasp financial processes. Bridging this gap demands significant investment in training, upskilling, and cross-functional collaboration to ensure successful adoption and use of AI technologies.

Implementation and Integration Barriers

Integrating AI into existing financial systems can be challenging, particularly for companies with outdated or incompatible infrastructure. Legacy systems may not support modern AI tools, leading to costly upgrades or the need for entirely new platforms. Additionally, the complexity of customizing AI to suit specific accounting workflows can delay implementation and increase project risk. Overcoming these barriers requires clear planning, the right technical support, and a commitment to long-term innovation.

What is the Future of Accounting and Finance with AI?

Predictions for 2030 and Beyond

The future of accounting and finance with AI is expected to be transformative by 2030 and beyond. AI will no longer be seen as a supporting tool but as a central component of financial operations. Predictive analytics will become even more precise, enabling companies to forecast market shifts and manage risk in real-time. Fully autonomous systems may handle transactional tasks, audits, and compliance checks with minimal human intervention, improving speed, accuracy, and decision-making.

The Evolving Role of Finance Professionals

As AI takes over repetitive and rules-based processes, the role of finance professionals will shift toward more strategic and analytical functions. Rather than focusing on data entry or reconciliations, accountants and financial analysts will be expected to interpret AI-generated insights, guide business strategy, and ensure ethical and compliant AI usage. The profession will demand stronger soft skills such as critical thinking, communication, and problem-solving, alongside technical fluency in AI tools and data systems.

Lifelong Learning and AI Upskilling Opportunities

To remain relevant in this evolving landscape, finance professionals must embrace lifelong learning and continuous upskilling. Online courses, certifications in AI and data analytics, and hands-on experience with tools like machine learning and robotic process automation will be crucial. Organizations will also need to invest in internal training programs and partnerships with educational institutions to build AI-literate finance teams.

The integration of AI is not a threat but a growth opportunity—empowering finance professionals to focus on higher-value activities and drive innovation. By 2030, those who proactively adapt and evolve alongside AI will lead the future of finance.

How to Learn AI for Finance & Accounting?

Recommended Online Courses and Certifications

Learning AI for finance & accounting has never been more accessible, thanks to a range of online courses and certifications. Platforms like Coursera, edX, and Udemy offer beginner to advanced courses on AI applications in finance. Look for programs that combine theoretical understanding with hands-on practice. LAI (Learn Artificial Intelligence) offers specialized courses tailored to finance professionals, covering topics like machine learning for financial modelling, AI-driven auditing, and automation in accounting systems. These courses are designed to be flexible, affordable, and practical for professionals at any stage of their career.

Skills Finance Professionals Should Focus On

To thrive in this evolving space, finance professionals should focus on both technical and analytical skills. Key areas include:

- Basic programming (especially in Python) for data analysis and model building

- Data literacy – understanding how to clean, interpret, and visualize data

- AI and machine learning fundamentals – concepts like classification, regression, and clustering

- Financial analytics – how to apply AI models to budgeting, forecasting, and risk assessment

- Ethics and governance in AI to ensure compliance and transparency

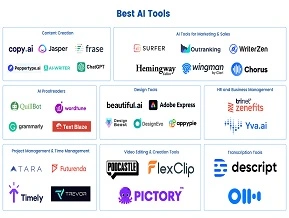

Tools and Platforms Worth Exploring

Several tools are especially valuable when learning AI for finance & accounting. Python is a leading language for AI development, with libraries like Pandas, NumPy, and Scikit-learn widely used in financial modelling. Excel now includes AI-powered features that support forecasting and automation. Tableau is excellent for visualizing financial data and AI outputs, while platforms like SAP and QuickBooks are integrating AI to automate processes and generate real-time insights.

By mastering these tools and concepts, finance professionals can future-proof their careers and play a central role in AI-powered financial decision-making.

What are the Ethical and Regulatory Considerations for AI in Finance & Accounting?

Importance of Transparency and Explain ability

One key ethical concern is transparency—stakeholders must understand how AI algorithms make decisions, especially in areas like credit scoring, fraud detection, or investment analysis. Explainable AI (XAI) helps provide insights into model behaviour, reducing the risk of bias and building trust with regulators, clients, and internal teams.

Navigating Global and Regional AI Regulations

Finance professionals must stay informed about rapidly evolving legal frameworks. Regulations such as the General Data Protection Regulation (GDPR) in the EU and other financial compliance laws worldwide impose strict guidelines on how data is collected, stored, and processed. Many countries are also introducing AI-specific regulations to ensure fairness, accountability, and consumer protection. Navigating this patchwork of global and regional rules requires a solid understanding of both AI capabilities and legal obligations.

Balancing Automation with Ethical Accountability

While AI offers efficiency and speed, over-reliance on automation can lead to unintended consequences. Ethical considerations demand that companies critically assess the impact of AI systems—particularly when they affect financial outcomes for individuals or businesses. Questions around fairness, bias, and consent must be addressed during the design, deployment, and monitoring of AI applications in finance.

The Role of Human Oversight

Human oversight remains essential in AI-driven finance processes. Even the most advanced algorithms can make errors or produce biased outcomes. By involving finance professionals in the review and validation of AI-generated results, organizations can ensure ethical accountability and maintain compliance with industry standards. Oversight also provides a safeguard against over-automation, helping to preserve human judgment and professional integrity in financial decision-making.

Conclusion

The rise of AI in Finance & Accounting marks a transformative shift in how businesses manage financial operations. By leveraging technologies like machine learning, automation, and data analytics, organizations can improve accuracy, reduce costs, and enhance decision-making processes. As we move further into 2025, adapting to this evolution is essential. Companies that embrace AI will be better positioned to navigate complex markets, meet regulatory demands, and achieve sustainable growth. In a rapidly changing landscape, the integration of AI into accounting and finance is not just a trend—it is a strategic imperative for long-term success.