How AI in Accounting Software is Revolutionising Financial Management?

What is the Role of AI in Accounting Software?

Understanding AI in Accounting Software

AI in accounting software refers to the integration of artificial intelligence technologies into financial tools to automate, optimize, and enhance accounting tasks. From data entry to fraud detection, AI is reshaping how businesses manage their finances. These intelligent systems are capable of learning from data, recognizing patterns, and making informed decisions with minimal human intervention.

Real-World Applications of AI in Accounting

Modern accounting software now includes several AI-driven features that simplify and speed up financial processes. Common examples include automated invoice processing, predictive cash flow analysis, smart expense categorization, and real-time financial reporting. AI can also assist in tax compliance by identifying relevant tax codes and flagging potential errors. Additionally, AI-powered chatbots are increasingly used in customer support to handle routine financial queries and provide quick assistance to users.

Why AI is the Future of Digital Accounting?

The integration of AI into accounting systems is not just a trend—it’s a strategic evolution. As businesses generate more financial data than ever before, traditional accounting methods struggle to keep up. AI offers scalability, improved accuracy, and enhanced decision-making. It helps accountants and finance teams move from manual, repetitive tasks to more strategic roles focused on analysis and planning. AI also ensures greater compliance by continuously monitoring transactions and highlighting anomalies.

It represents the next generation of financial technology. It empowers organizations to operate more efficiently, reduce errors, and gain deeper insights into their financial health. As AI tools become more accessible and user-friendly, their adoption in accounting is expected to grow rapidly, transforming the finance industry in the years to come.

What are the Key Benefits of AI in Accounting Software?

Boosting Speed and Efficiency

One of the most significant advantages of integrating accounting software and AI is the dramatic increase in speed and efficiency. AI automates time-consuming tasks such as data entry, invoice matching, and bank reconciliation. This automation allows finance teams to process large volumes of transactions quickly, freeing up valuable time for more strategic activities. As a result, businesses can close books faster and respond to financial insights more rapidly.

Enhancing Accuracy and Reducing Errors

Human error is a common challenge in accounting, especially when dealing with complex datasets or repetitive processes. AI significantly reduces this risk by automating calculations and validations. It ensures data consistency and flags anomalies that may require human attention. This leads to more accurate financial statements and reduces the likelihood of costly mistakes.

Supporting Compliance and Regulatory Reporting

In today’s highly regulated financial environment, compliance is non-negotiable. AI supports accounting software by monitoring transactions in real-time, applying relevant tax rules, and generating audit-ready reports. It also helps ensure that businesses meet local and international accounting standards by updating regulatory rules automatically. This proactive approach minimizes the risk of non-compliance and associated penalties.

Enabling Real-Time Data Analysis and Forecasting

With AI, accounting systems can analyse vast amounts of financial data in real time. This capability allows businesses to make faster, data-driven decisions. AI can identify trends, forecast cash flow, and predict future financial performance with greater precision. These insights are invaluable for strategic planning, budgeting, and investment decisions. The combination of both is transforming financial management. From speeding up routine processes to delivering powerful forecasting tools, AI brings measurable value to businesses aiming for smarter, more reliable accounting solutions.

How Accounting Software and AI Work Together?

Automating Routine Accounting Tasks

The integration of accounting software and AI enables the automation of repetitive and time-consuming tasks such as data entry, bank reconciliations, and invoice processing. AI algorithms can extract relevant data from receipts or invoices, match transactions to bank statements, and update ledgers automatically. This not only speeds up workflow but also reduces the chance of manual errors, making day-to-day accounting more efficient and accurate.

Smart Categorisation and Anomaly Detection

AI enhances accounting software with the ability to intelligently categorise transactions based on past behaviour and predefined rules. It learns over time to accurately assign expenses and revenues to the appropriate accounts. Additionally, AI is capable of detecting unusual patterns or anomalies—such as duplicate payments or irregular spending—which may indicate errors or fraud. These early warnings help businesses act quickly and maintain financial integrity.

Adaptive Financial Models with Machine Learning

Machine learning, a subset of AI, allows accounting software to evolve and improve over time. As the system processes more financial data, it becomes better at predicting trends, estimating cash flow, and identifying financial risks. These adaptive financial models provide businesses with deeper insights and more accurate forecasts, supporting better strategic decision-making.

Voice-Activated Commands with NLP

Natural Language Processing (NLP) brings conversational capabilities to accounting platforms. Users can now interact with software using voice commands or plain language, making it easier to generate reports, input expenses, or ask financial questions. For example, simply saying, “Show last month’s expenses,” can trigger a report without navigating through multiple menus. The collaboration between both is revolutionising how businesses handle their finances. From smart automation to predictive insights and intuitive interfaces, this powerful combination is shaping the future of accounting.

What are the Real-World Use Cases of AI in Accounting Software Across Industries?

Smarter Automation for Small Businesses

One of the most impactful uses of AI in accounting software is helping small businesses automate daily financial operations. AI streamlines processes like expense tracking, invoice generation, and payroll management. For example, a small retail store can use AI-powered tools to automatically categorise expenses and monitor incoming payments, providing real-time cash flow insights. This helps business owners make informed financial decisions without needing a dedicated finance team.

Advanced Forecasting and Fraud Detection for Enterprises

Large enterprises benefit from the scalability and intelligence of AI-driven accounting systems. AI enhances forecasting capabilities by analysing historical financial data, market trends, and seasonal fluctuations. This allows companies to project future revenues, manage budgets, and plan long-term investments with higher confidence. Additionally, AI plays a critical role in fraud detection. By continuously scanning large volumes of transactions, AI can identify suspicious activity—such as unauthorized payments or abnormal spending patterns—faster than traditional methods.

AI-Powered Auditing and Compliance Monitoring

AI is also transforming the auditing process and improving compliance efforts across industries. In accounting software, AI can automatically review financial records, verify document consistency, and highlight discrepancies that might go unnoticed by human auditors. For compliance, AI ensures that accounting practices align with current laws and regulations by flagging potential issues in real time. This is especially valuable in industries with complex regulatory requirements such as healthcare, finance, and manufacturing. the application of this software is broad and impactful. Whether it's supporting small businesses with automation or helping large corporations detect fraud and maintain compliance, AI is proving to be a transformative force in financial management across all sectors.

What are the Challenges and Considerations When Using Accounting Software and AI?

Protecting Data Privacy and Security

While the use of accounting software and AI offers major benefits, it also raises important concerns about data privacy and security. Financial data is highly sensitive, and any breach can lead to serious consequences including financial loss and reputational damage. AI systems require access to large volumes of data, which increases the risk of exposure if proper safeguards are not in place. Businesses must ensure their accounting software uses strong encryption, access controls, and compliance with data protection regulations such as GDPR.

Integration and Training Requirements

Another challenge is the integration of AI-powered accounting tools with existing business systems. Legacy software may not be compatible with newer AI technologies, requiring time and investment to upgrade or replace. Additionally, employees need proper training to effectively use new AI features. Without adequate support and user education, the potential of AI can remain untapped. Businesses must plan for both the technical and human aspects of implementation to ensure a smooth transition.

Dependence on Data Quality and Transparency

AI’s effectiveness in accounting depends heavily on the quality of the data it receives. Inaccurate, incomplete, or outdated data can lead to incorrect outputs, from faulty forecasts to missed compliance issues. Moreover, many AI systems operate as “black boxes,” where decision-making processes are not always clear. This lack of transparency can create trust issues, especially in regulated industries where financial accountability is critical. While both offer transformative capabilities, businesses must address challenges related to security, integration, training, and data quality. With careful planning and responsible AI adoption, these concerns can be managed to unlock the full potential of intelligent accounting.

What are the Future Trends for AI in Accounting Software?

Smarter Decisions with Predictive Analytics

The future of AI in accounting software is increasingly driven by predictive analytics. These tools go beyond historical reporting to anticipate future financial outcomes based on current and past data. For example, AI can forecast revenue trends, predict cash flow fluctuations, and even flag potential financial risks before they occur. This allows businesses to make proactive, data-driven decisions and plan with greater confidence.

AI-Powered Virtual Financial Advisors

Another emerging trend is the rise of AI-powered virtual financial advisors within accounting platforms. These intelligent assistants can offer tailored financial guidance, answer complex queries, and help users optimize budgets or tax strategies. Whether it's suggesting cost-saving measures or recommending investment decisions, virtual advisors make financial insights more accessible to both individuals and small businesses—without the need for a full-time accountant.

The Convergence of Blockchain and AI

Blockchain offers transparent, tamper-proof records, while AI can analyse and automate these records for improved accuracy and efficiency. Together, they create highly secure and auditable financial systems. This integration is expected to revolutionize functions like auditing, transaction verification, and fraud detection—bringing new levels of trust and automation to the industry. The future of this software promises smarter tools, deeper insights, and more secure financial systems. With advancements in predictive analytics, intelligent virtual advisors, and blockchain integration, AI is poised to redefine the way businesses and individuals manage their finances. Staying ahead of these trends will be essential for organizations looking to remain competitive in an increasingly data-driven world.

How Can you Get Started with Learning AI for Financial Applications?

Why Finance Professionals Should Upskill in AI?

In today’s evolving digital economy, learning about AI for financial applications is becoming essential for accounting and finance professionals. As AI continues to automate routine tasks, professionals who understand how to work with AI tools will be better equipped to stay competitive and add strategic value. Whether you're an accountant, auditor, or financial analyst, developing AI skills will help you interpret insights, guide decision-making, and lead digital transformation in your organization.

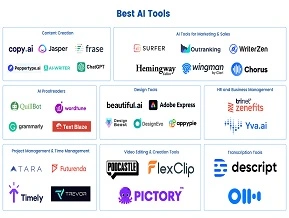

Top AI Courses and Tools for Accounting

Several high-quality learning resources are available to help finance professionals get started with AI. Beginner-friendly online courses such as “AI for Everyone” by Andrew Ng and “AI in Finance” by Coursera or edX are excellent entry points. For hands-on experience, tools like Python, TensorFlow, and financial modelling libraries can help you understand how AI models are built and applied. Specialized software such as QuickBooks with AI features or Microsoft Power BI with AI integration can also be explored for practical insights.

How LAI Can Help you Master AI in Accounting?

At Learn Artificial Intelligence (LAI), we offer tailored courses designed specifically for finance professionals looking to embrace the power of AI. Our beginner-friendly modules cover core concepts like machine learning, automation in accounting, AI ethics, and real-world applications. You'll learn how to apply AI to everyday accounting tasks and gain confidence in using modern tools that are transforming the industry. With interactive lessons, case studies, and support from experts, LAI provides the practical knowledge you need to future-proof your career.

In conclusion, mastering AI for financial applications is a smart move for any professional in the finance sector. With the right resources and guidance, you can turn AI from a buzzword into a powerful skillset that drives real-world impact.

Conclusion

The integration of AI in accounting software is revolutionizing financial management by automating tasks, enhancing accuracy, and delivering real-time insights. From small businesses to large enterprises, the benefits of this technology are clear. As accounting software and AI continue to evolve, professionals who embrace these tools will be better prepared to navigate the future of finance. Staying ahead means not only using smart software but also understanding how it works. Exploring AI education is a valuable step toward building future-ready skills and ensuring long-term success in the ever-changing financial landscape. Now is the time to learn, adapt, and lead.