Beginner’s Guide to AI for Financial Services Everything You Need to Know

How is AI Transforming the Financial Services Landscape?

AI for Financial Services is reshaping how financial institutions operate, offering enhanced efficiency, security, and customer satisfaction. By integrating advanced technologies such as machine learning and data analytics, the industry is better equipped to respond to complex challenges.

AI in Fraud Detection and Prevention

AI plays a crucial role in identifying fraudulent activities in real time. Through continuous monitoring of transaction patterns and behavioural data, AI systems can detect anomalies and flag suspicious activities before they escalate. This proactive approach significantly reduces financial losses and boosts customer trust.

AI for Risk Assessment and Credit Scoring

Lenders use AI models to assess creditworthiness with higher precision. These systems analyse a broader range of data, including transaction history, social behaviour, and alternative financial data, to produce more accurate credit scores. This results in fairer and faster lending decisions.

Algorithmic Trading and Portfolio Management

In the trading world, AI algorithms process vast amounts of market data to make rapid investment decisions. These systems identify trends and optimize portfolio strategies to maximize returns and reduce risks. AI-driven trading offers speed and accuracy that human traders can't match.

Customer Service Automation Using AI Chatbots

AI-powered chatbots are revolutionizing customer service in financial institutions. These virtual assistants provide 24/7 support, handle routine queries, and guide customers through complex processes. They not only enhance user experience but also reduce operational costs.

Regulatory Compliance and Reporting Powered by AI

Compliance is a critical area in finance. AI solutions help institutions stay ahead of evolving regulations by automating data collection, analysis, and reporting. This ensures accuracy and reduces the risk of non-compliance penalties.

How Are Real-World Case Studies Driving Innovation in AI for Financial Services?

AI for Financial Services is no longer just a futuristic concept—it's delivering measurable value across banking and fintech sectors. From reducing fraud to enhancing customer experience, AI is reshaping financial services with tangible results.

Successful AI Implementations in Banks and Fintech Companies

Leading banks such as JPMorgan Chase and fintech companies like Upstart have successfully deployed AI across various operations. JPMorgan’s COiN platform uses AI to review legal documents, saving thousands of hours annually. Meanwhile, Upstart leverages AI for credit decisioning, enabling faster loan approvals with lower default rates. These implementations showcase how AI can streamline complex tasks and drive business growth.

Lessons Learned from Early Adopters of AI

Early adopters of AI technologies have shared valuable insights. One key lesson is the importance of data quality—AI systems are only as effective as the data they’re trained on. Institutions also realized that successful adoption requires a cultural shift, emphasizing collaboration between data scientists and domain experts. Incremental implementation, starting with pilot projects, also proved essential for managing risk and optimizing performance.

Measurable Outcomes and ROI from AI-Driven Initiatives

The benefits of AI are not just theoretical. For instance, HSBC reported a 20% reduction in compliance costs using AI-powered anti-money laundering tools. Similarly, Capital One improved customer retention rates by enhancing service personalization through AI. These examples illustrate the strong ROI and operational efficiencies driven by intelligent automation and analytics.

In summary, these are increasingly intertwined, with real-world case studies offering proof of concept and a blueprint for future success. As adoption grows, the financial sector will continue to unlock new levels of innovation and value through AI.

How AI and Financial Services Work Together to Improve Efficiency?

AI and Financial Services form a powerful combination that drives significant improvements in speed, accuracy, and customer satisfaction across the industry. By integrating artificial intelligence into key operations, financial institutions are transforming how they serve clients and manage internal processes.

Automating Routine Processes for Faster Service Delivery

AI excels at handling repetitive tasks, such as data entry, transaction processing, and document verification. Banks and insurance companies now use robotic process automation (RPA) powered by AI to streamline back-office functions. This not only speeds up service delivery but also reduces human error, allowing employees to focus on higher-value activities.

Enhancing Data Analysis for Better Decision-Making

The financial sector relies heavily on data. AI enhances this by processing vast amounts of structured and unstructured data in real time. This allows for faster, more informed decision-making in areas like investment strategy, risk management, and market analysis. AI tools can uncover hidden patterns, predict market trends, and support smarter financial planning.

Personalizing Financial Products and Services with AI

AI enables institutions to offer personalized experiences by analysing customer behaviour, preferences, and transaction history. This personalization helps deliver targeted financial products such as loans, insurance plans, and investment advice. It also improves customer engagement and satisfaction, making services more relevant and timely.

Reducing Operational Costs with AI-Driven Automation

By automating manual tasks and optimizing workflows, AI significantly reduces operational costs. Institutions report lower overheads, increased productivity, and faster turnaround times. This cost efficiency not only benefits the business but also leads to more competitive pricing for customers.

What are the Benefits of AI for Financial Services Institutions?

AI for Financial Services institutions is driving a major transformation, delivering enhanced performance, accuracy, and customer satisfaction. From back-office efficiency to real-time fraud detection, the benefits are wide-ranging and impactful.

Improved Accuracy and Reduced Human Error

One of the most significant advantages of AI is its ability to process data with high precision. By automating tasks such as data entry, compliance checks, and loan underwriting, AI reduces the risk of human error. Financial institutions can rely on AI to maintain consistency and accuracy in complex processes that were once prone to mistakes.

Enhanced Security and Fraud Mitigation

AI has become a powerful tool in combating financial fraud. Machine learning models can detect unusual patterns in real time, flagging suspicious activities that might go unnoticed by traditional systems. This proactive approach strengthens overall security and helps institutions protect both customer data and company assets.

Better Customer Experience and Engagement

AI is revolutionizing customer service by enabling personalized experiences. Chatbots, virtual assistants, and AI-driven recommendation engines help deliver instant, accurate, and relevant responses to customer inquiries. By understanding customer behaviour and preferences, institutions can tailor their products and services, resulting in stronger engagement and satisfaction.

Competitive Advantage in a Rapidly Evolving Market

In a fast-changing financial landscape, AI offers institutions the ability to innovate rapidly and stay ahead of competitors. From predictive analytics to smarter investment strategies, AI equips organizations with insights that lead to better decision-making and improved agility. This not only strengthens market position but also enhances long-term growth potential.

In summary, AI for Financial Services is more than a technological upgrade—it’s a strategic asset that delivers measurable benefits across every level of a financial institution.

What are the Challenges and Risks of Implementing AI in Financial Services?

AI in Financial Services is driving innovation, but its implementation is not without challenges. Institutions adopting AI must carefully navigate technical, ethical, and regulatory risks to unlock its full potential responsibly and effectively.

Data Privacy and Ethical Considerations

AI systems rely heavily on customer data to function effectively. However, this raises serious concerns about data privacy, consent, and ethical use. Financial institutions must ensure that AI applications comply with data protection laws and do not misuse sensitive information. Balancing innovation with ethical responsibility is a critical challenge in AI deployment.

Integration with Legacy Systems

Many banks and financial institutions still operate on legacy IT infrastructure. Integrating AI tools into these outdated systems can be complex and costly. Compatibility issues, lack of scalability, and the need for significant upgrades often slow down implementation, making it harder to realize the benefits of AI quickly.

Managing Biases in AI Algorithms

AI algorithms can unintentionally reflect or even amplify biases present in training data. In financial services, this can lead to unfair lending decisions, discriminatory practices, or flawed risk assessments. Institutions must invest in transparent model design and continuous monitoring to minimize algorithmic bias and promote fairness.

Regulatory Hurdles and Compliance Requirements

The regulatory landscape for AI in finance is still evolving. Governments and regulatory bodies are increasingly focused on ensuring responsible AI use. Financial institutions must stay ahead of changing compliance requirements, which can be challenging given the pace of technological advancement. Failure to do so may result in fines, reputational damage, or legal issues.

In conclusion, while AI in Financial Services offers transformative potential, its implementation must be approached thoughtfully. Overcoming these challenges requires careful planning, cross-functional collaboration, and a strong focus on ethics and governance.

What are Future Trends in AI and Financial Services?

AI and Financial Services are advancing hand-in-hand, shaping the future of how financial institutions operate, invest, and interact with customers. Emerging technologies and evolving needs are driving new trends that are poised to redefine the industry.

Increasing Adoption of AI-Powered Robo-Advisors

Robo-advisors are becoming a key tool in digital wealth management. These AI-driven platforms provide automated, low-cost investment advice based on individual risk profiles and financial goals. As technology matures, robo-advisors are expected to offer even more personalized insights and manage larger portfolios with greater accuracy, appealing to both retail and institutional investors.

Expansion of AI in Blockchain and Cryptocurrency

AI is playing a growing role in optimizing blockchain networks and managing cryptocurrency markets. From fraud detection in crypto transactions to intelligent contract auditing and price prediction, AI brings efficiency and security to this fast-evolving space. The fusion of AI and blockchain is expected to unlock new financial products and decentralized finance (DeFi) applications.

Use of Explainable AI (XAI) for Transparency

As financial services adopt more complex AI models, the demand for transparency is rising. Explainable AI (XAI) helps institutions understand how AI makes decisions, particularly in sensitive areas like credit scoring or compliance. XAI fosters trust among stakeholders, customers, and regulators by making AI behaviour more interpretable and accountable.

The Growing Role of AI in Financial Cybersecurity

Cybersecurity threats are increasing in sophistication, and AI is becoming a frontline defence tool. AI systems can detect unusual patterns in real time, prevent breaches, and respond quickly to incidents. As financial institutions digitize further, AI will be crucial in safeguarding data, systems, and customer trust.

In summary, the evolving partnership between AI and Financial Services will continue to drive innovation, enhance security, and improve customer experiences in the years ahead.

How Can You Get Started with AI for Financial Services Through Skills and Education?

AI for Financial Services is transforming the finance industry, and professionals looking to stay relevant must equip themselves with the right skills and knowledge. As AI continues to evolve, acquiring technical expertise and a strong foundation in data science is essential for career growth.

Essential AI and Data Science Skills for Finance Professionals

To work effectively with AI in a financial context, professionals should build competence in data analysis, machine learning, and statistical modelling. Knowledge of programming languages such as Python or R is highly valuable, especially for developing predictive models or automating financial tasks. Additionally, understanding financial markets, risk management, and quantitative analysis provides the necessary context for applying AI effectively.

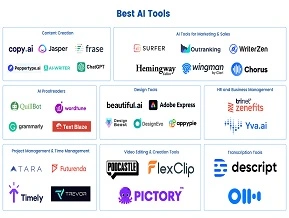

Recommended AI Courses and Certifications

Several online platforms offer quality courses tailored to AI and finance. Programs such as Coursera’s “AI for Everyone” by Andrew Ng, edX’s “Data Science for Finance,” and certifications like IBM’s AI Engineering Professional Certificate or CFA Institute’s Data Science for Investment Professionals are excellent starting points. These courses cover both foundational and advanced topics, helping professionals bridge the gap between theory and practical application.

How Continuous Learning Can Keep You Ahead in the Industry

The rapid pace of change in AI for Financial Services means that ongoing education is critical. Professionals must stay updated with the latest trends, tools, and regulatory developments. Participating in webinars, joining AI and fintech communities, attending industry conferences, and reading research papers are all valuable ways to remain informed and competitive in the field.

In summary, gaining the right skills and committing to lifelong learning are essential steps for anyone looking to thrive in the age of AI-driven finance.

Conclusion

AI and Financial Services are reshaping the financial industry by improving accuracy, enhancing customer experiences, and reducing operational costs. As this transformation accelerates, finance professionals must adapt by gaining relevant AI skills. Exploring AI training programs at LAI is a great starting point, offering practical knowledge tailored to the needs of modern financial institutions. Embracing continuous learning and technological innovation will ensure professionals stay competitive in this evolving landscape. Ultimately, those who integrate AI into their financial expertise today will be better positioned to lead in a smarter, more efficient and data-driven future of finance.