AI Bookkeeping: How Artificial Intelligence is Automating Small Business Finances?

What is AI bookkeeping?

AI bookkeeping is transforming how small businesses manage their financial records by automating routine tasks using artificial intelligence technologies. It refers to the use of smart software systems that can learn from data, make decisions, and perform accounting tasks with minimal human intervention. Unlike traditional bookkeeping methods that rely heavily on manual data entry, spreadsheets, and human oversight, bookkeeping introduces speed, accuracy, and efficiency into the process.

These intelligent systems use technologies like machine learning (ML), natural language processing (NLP), and robotic process automation (RPA) to analyse financial documents, categorize transactions, detect patterns, and even flag unusual activity. For example, AI-powered tools can scan invoices and receipts, extract relevant information, and automatically record them in the correct accounts—saving hours of tedious work. They can also reconcile bank statements, generate financial reports, and provide real-time insights into business performance, all with minimal input from the user.

Why AI Bookkeeping Matters for Small Businesses?

For small businesses, staying on top of finances is critical but it’s also time-consuming and prone to errors. Bookkeeping offers a smarter solution by reducing the manual workload and improving accuracy. With real-time data processing and intelligent categorization of expenses, small business owners can make faster, data-driven decisions without being bogged down by spreadsheets or paperwork. Additionally, AI can automatically sync with bank accounts, track expenses, and generate reports freeing up valuable time that entrepreneurs can use to grow their business. This level of automation can be a game-changer for small businesses operating with limited staff and tight budgets.

How AI Is Changing Traditional Bookkeeping?

Traditional bookkeeping involved time-intensive tasks such as entering transactions, reconciling accounts, and generating financial statements all done by hand or with basic accounting software. With the rise of bookkeeping, these tasks are now being handled by intelligent systems that can learn and adapt over time. AI tools can scan receipts, read invoices, and classify transactions automatically, significantly reducing the chances of human error. Moreover, many bookkeeping solutions offer predictive analytics to forecast cash flow, identify trends, and alert users about potential financial risks.

What are the Basics of Bookkeeping and AI?

Bookkeeping and AI are coming together to revolutionize how businesses manage their financial data in today’s digital-first economy. By combining the foundational principles of accounting such as recording transactions, managing ledgers, and reconciling accounts with the advanced capabilities of artificial intelligence, companies can dramatically improve the speed, accuracy, and efficiency of their financial workflows. This integration is particularly valuable for small businesses, which often face limited time, staffing, and resources. With AI-driven bookkeeping solutions, these businesses can streamline daily operations, reduce costly errors, automate repetitive tasks, and gain real-time insights into their financial health all without needing extensive accounting expertise.

Key AI Technologies Used in Bookkeeping

Several AI technologies play a central role in modern bookkeeping systems. Machine Learning (ML) enables software to learn from historical financial data and become increasingly accurate at tasks like categorizing expenses and predicting cash flow. As the system processes more data, its performance and reliability improve over time. Natural Language Processing (NLP) allows AI to understand and extract information from unstructured text sources such as email receipts, invoices, and bank statements, significantly reducing the need for manual data entry. Additionally, Automation and Robotic Process Automation (RPA) help manage repetitive bookkeeping tasks like invoice processing, transaction recording, and account reconciliation without human involvement, resulting in faster and more dependable financial operations.

Common Bookkeeping Tasks AI Can Automate

AI is capable of automating a wide range of routine bookkeeping tasks, including transaction categorization (automatically assigning income or expenses to the correct account), invoice scanning and processing (reading invoice details and entering them into accounting systems), bank reconciliation (matching bank statements with recorded transactions), and report generation (creating profit and loss statements, balance sheets, and cash flow reports in real-time).

What are the Benefits of AI Bookkeeping for Small Businesses?

AI bookkeeping for small businesses is proving to be a true game-changer in the way financial management is handled. Small business owners often juggle many responsibilities, and managing finances manually can be time-consuming and prone to mistakes. By automating essential accounting tasks such as transaction categorization, invoice processing, and report generation AI-powered bookkeeping tools significantly reduce the need for manual data entry and oversight. This automation not only speeds up bookkeeping processes but also minimizes human errors, giving business owners peace of mind. As a result, small businesses can operate more efficiently, with smoother cash flow management and clearer financial insights.

Increased Accuracy and Fewer Errors

Manual bookkeeping is prone to human error, whether it's entering incorrect numbers, overlooking transactions, or misclassifying expenses. AI systems, on the other hand, are designed to process large volumes of financial data with a high degree of accuracy. They use machine learning algorithms to detect inconsistencies and flag potential mistakes, reducing the risk of costly errors. Over time, these systems can even learn from previous corrections to improve future performance. This level of accuracy not only ensures cleaner books but also provides more reliable data for making informed business decisions.

Time and Cost Savings

One of the most immediate benefits of bookkeeping is the time it saves. Traditional bookkeeping tasks like categorizing transactions, generating reports, and reconciling accounts can take hours each week. AI automates these repetitive activities, freeing up time for small business owners to focus on strategy, growth, and customer service. In addition to saving time, automation also helps reduce labour costs. Businesses may be able to operate with smaller accounting teams or reduce their reliance on outsourced bookkeeping services, resulting in significant cost savings over time.

How Bookkeeping and AI Work Together in Practice?

The integration of bookkeeping and AI is fundamentally transforming everyday financial tasks for small businesses by making them faster, more accurate, and significantly less labour-intensive. Traditionally, bookkeeping required hours of manual data entry, reconciliation, and error checking processes that could be overwhelming for small business owners juggling multiple responsibilities. With AI technologies now embedded into bookkeeping software, many of these routine tasks are automated, freeing up valuable time and reducing costly mistakes. This collaboration between human expertise and intelligent machines is reshaping how small businesses handle their finances. To better understand this shift, let’s explore how bookkeeping and AI work together in practice, highlighting real-world examples and common use cases that showcase the tangible benefits for small business owners.

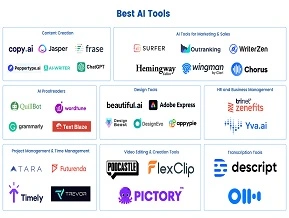

Examples of AI Bookkeeping Software Tools for Small Businesses

Many AI-powered bookkeeping software solutions have emerged to help small businesses manage their finances more effectively. Popular tools like QuickBooks Online, Xero, and FreshBooks now incorporate AI features that automate data entry, categorize transactions, and generate financial reports automatically. More specialized platforms, such as Botkeeper and Receipt Bank, use AI to process receipts and invoices by scanning and extracting key information, eliminating the need for manual input. These tools continuously learn from the data they process, improving their accuracy and efficiency over time, which helps small business owners save time and reduce costly mistakes.

Automating Invoice Processing and Expense Tracking

One of the most powerful applications of AI in bookkeeping is automating invoice processing and expense tracking. Traditionally, businesses had to manually enter invoice details and match them with payments a tedious and error-prone process. AI systems can now scan invoices, extract relevant details such as dates, amounts, and vendor information, and automatically record these in the accounting system. Similarly, AI can track expenses by linking bank transactions or credit card charges to the right accounts. This not only speeds up bookkeeping but also ensures more accurate financial records, helping small businesses maintain a clear picture of their cash flow and financial health in real time.

What are the Challenges and Considerations of Implementing AI Bookkeeping?

While AI bookkeeping offers numerous advantages for small businesses, such as improved efficiency, accuracy, and cost savings, implementing these advanced systems is not without its challenges. Business owners need to be aware of several important considerations before adopting AI solutions, including potential technical complexities, integration with existing financial processes, and the need to maintain control over sensitive financial data. Understanding these challenges upfront can help ensure a smoother transition and maximize the benefits of AI-powered bookkeeping tools.

Data Privacy and Security Concerns

One of the foremost concerns when adopting bookkeeping tools is data privacy and security. Financial information is highly sensitive, and small businesses must ensure that their data is protected from breaches and unauthorized access. AI systems often require access to extensive financial records and personal data, which makes them a potential target for cyber-attacks. It is crucial for businesses to choose bookkeeping solutions with strong encryption, secure cloud storage, and robust security protocols. Additionally, compliance with data protection regulations such as GDPR or CCPA must be considered, especially for companies operating internationally. Without proper safeguards, businesses risk exposing confidential financial information, which could lead to legal and reputational damage.

Need for Human Oversight despite Automation

Another important consideration is that despite the automation capabilities of bookkeeping, human oversight remains essential. AI can efficiently handle routine tasks, but it may not catch every error or interpret complex financial situations correctly. Small business owners or their accountants must regularly review AI-generated reports and transactions to ensure accuracy and compliance. Over-reliance on AI without proper supervision could result in overlooked mistakes or misclassified entries that might affect tax filings or financial analysis. Thus, while bookkeeping significantly reduces manual workload, it does not eliminate the need for skilled professionals to monitor and guide the process.

What are the Future Trends in AI Bookkeeping and Small Business Finance?

The landscape of AI bookkeeping and small business finance is rapidly evolving, fuelled by continuous advancements in artificial intelligence technologies and increasing adoption among businesses of all sizes. As AI algorithms become more sophisticated, they are enabling smarter automation that goes beyond basic data entry and categorization. These innovations promise not only to simplify financial management for small businesses but also to enhance accuracy, reduce errors, and provide deeper strategic insights. With AI tools increasingly capable of analysing large datasets in real time, small business owners can expect to gain more proactive financial advice, better forecasting, and improved decision-making support all of which are critical for maintaining competitiveness in a dynamic market.

Emerging AI Capabilities in Bookkeeping

Future bookkeeping systems will become even more sophisticated by incorporating advanced capabilities such as predictive analytics, anomaly detection, and real-time financial forecasting. These technologies will not only automate routine tasks but also help small businesses anticipate cash flow issues, identify unusual transactions, and optimize budgeting decisions. Machine learning models will increasingly learn from vast amounts of financial data to offer personalized recommendations tailored to each business’s unique financial patterns. This level of intelligence will enable small businesses to proactively manage their finances rather than just react to past transactions.

Integration with Other AI-Driven Business Tools

Another key trend is the seamless integration of bookkeeping with other AI-powered business solutions, such as tax preparation, payroll processing, and customer relationship management (CRM) systems. These integrated platforms will provide a unified view of a company’s financial and operational health, reducing the need for manual data transfers between separate software. For example, AI can automatically sync bookkeeping records with payroll systems to ensure accurate tax withholdings and timely salary payments. Similarly, AI-driven tax tools will use bookkeeping data to optimize deductions and compliance automatically. This ecosystem of interconnected AI tools will create a more efficient and cohesive workflow for small businesses, saving time and reducing errors.

How to Get Started with AI Bookkeeping for Your Small Business?

Adopting bookkeeping for your small business can dramatically improve the efficiency, accuracy, and overall quality of your financial management. By automating repetitive and time-consuming tasks, AI frees up valuable time for you and your team to focus on strategic decisions and business growth. However, getting started with bookkeeping is not just about picking any software it requires careful planning, understanding your business needs, and choosing the right tools that will seamlessly integrate with your current workflows. Proper implementation also involves training your staff and gradually transitioning from manual processes to automated systems to ensure a smooth and successful adoption. Here are some key steps to guide you through this important process.

Choosing the Right AI Bookkeeping Software

The first step in implementing bookkeeping is selecting software that fits your business needs. There are many AI-powered bookkeeping tools available, ranging from basic expense tracking apps to comprehensive accounting platforms with advanced AI features. Consider factors such as ease of use, integration capabilities with your existing systems, scalability, and customer support. Popular options like QuickBooks Online, Xero, and FreshBooks offer AI functionalities such as automated transaction categorization and invoice processing. If your business has specific needs, such as handling many invoices or international transactions look for software that specializes in those areas. Reading reviews and requesting demos can also help you make an informed choice.

Steps to Transition from Manual to AI Bookkeeping

Once you’ve chosen the right software, the transition from manual bookkeeping to AI-assisted processes should be gradual and well-planned. Start by backing up all your existing financial records to avoid data loss. Next, import your historical data into the new bookkeeping system to enable the software to learn your business patterns. Train your team on how to use the new tools effectively, emphasizing that AI is there to assist, not replace their judgment. Begin by automating simpler tasks like expense categorization and invoice scanning before gradually moving on to more complex processes such as bank reconciliation and financial reporting. Regularly review AI-generated reports to ensure accuracy during the early stages of implementation.

Conclusion

AI bookkeeping is revolutionizing the way small businesses handle their finances by automating routine tasks, increasing accuracy, and providing valuable insights. The combination of bookkeeping and AI enables business owners to save time, reduce errors, and focus on growth opportunities rather than manual number crunching. As technology continues to advance, embracing these AI tools is essential for staying competitive and efficient in today’s fast-paced market. Small businesses that adopt bookkeeping solutions can expect not only smoother financial management but also a stronger foundation for making smarter, data-driven decisions.