AI and Finance Industry the Future of Smart Financial Decision-Making

What is the intersection of AI and the Finance Industry?

The intersection of AI and the finance industry represents a powerful convergence of advanced technology and financial services aimed at enhancing efficiency, accuracy, and decision-making. Artificial Intelligence is being integrated into various financial operations such as risk assessment, fraud detection, algorithmic trading, customer service, and wealth management. By leveraging AI technologies like machine learning and data analytics, financial institutions can process massive volumes of data in real time, uncover patterns, and make predictive decisions with greater precision. This integration not only streamlines internal processes but also delivers more personalized and secure experiences to clients. As the industry continues to embrace digital transformation, AI is proving to be a critical driver of innovation and smart financial decision-making.

This fusion of AI and finance is reshaping traditional business models and creating new opportunities for growth and competitiveness. Financial institutions that adopt AI-driven solutions gain a significant advantage by reducing operational costs, minimizing human error, and improving compliance with regulatory requirements. Moreover, AI empowers banks and fintech companies to better understand customer behaviour and preferences, enabling them to offer tailored financial products and services. As AI technologies evolve, the finance industry is poised to become more proactive and adaptive, ultimately fostering greater trust and transparency between institutions and their clients. This ongoing transformation highlights why understanding the intersection of AI and the finance industry is essential for anyone looking to navigate or contribute to the future of finance.

AI and Finance Industry: A Transformative Relationship

In today’s rapidly evolving digital world, the intersection of AI and finance industry practices is creating a seismic shift in how financial decisions are made. AI and finance industry integration is no longer a futuristic concept—it’s a present-day reality that is revolutionizing everything from banking and investment to fraud detection and customer service. Artificial Intelligence (AI) brings a suite of technologies like machine learning, natural language processing, and predictive analytics that help financial institutions analyse massive datasets, uncover insights, automate routine tasks, and deliver personalized services to clients. As AI systems become more sophisticated, they enable smarter, faster, and more data-driven decisions—transforming the finance industry into a more agile and intelligent ecosystem.

The Importance of Smart Financial Decision-Making in the Digital Era

Financial markets and consumer behaviours are more dynamic than ever before. Human decision-making, while vital, is often too slow or limited to keep pace with the real-time demands of today’s financial world. Smart financial decision-making powered by AI allows institutions to identify trends, mitigate risks, and act with unprecedented accuracy. Whether it’s detecting fraudulent transactions instantly or tailoring investment strategies for individual clients, AI-driven systems are making financial decision-making more efficient and informed.

What is the Role of AI in the Finance Industry?

The role of AI in the finance industry is to enhance decision-making, improve operational efficiency, and create more personalized financial services. By leveraging technologies such as machine learning, natural language processing, and predictive analytics, AI enables financial institutions to analyse vast amounts of data quickly and accurately. This allows for better risk assessment, fraud detection, algorithmic trading, and customer support automation. AI-driven tools help banks and finch companies reduce costs, minimize errors, and respond proactively to market changes. As a result, AI is becoming an essential component in modern finance, driving innovation and transforming how financial services are delivered worldwide.

Defining Artificial Intelligence in the Finance Context

At its core, AI in finance industry refers to the use of advanced algorithms and computational models to simulate human intelligence in financial services. This includes the ability to analyse data, recognize patterns, make predictions, and automate complex processes. Unlike traditional software, AI systems learn and improve over time, enabling financial institutions to respond swiftly to market changes and customer needs with greater accuracy.

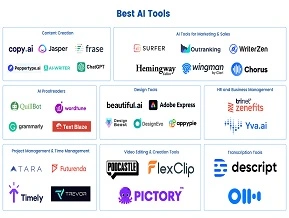

Key AI Technologies Powering Financial Services

Several AI technologies play a pivotal role in transforming the finance industry. Machine Learning (ML) algorithms analyse historical financial data to identify trends, predict market movements, and assess credit risk, which helps financial institutions make better investment decisions and detect fraudulent activities. Natural Language Processing (NLP) allows computers to understand and interpret human language, enabling chatbots and virtual assistants to provide customer support, while also analysing news and social media sentiment that can influence markets. Additionally, predictive analytics uses statistical methods and AI models to forecast future financial outcomes such as stock prices or loan defaults, allowing institutions to proactively manage risks and seize opportunities. Together, these technologies empower banks, investment firms, and finch companies to optimize operations, enhance customer experiences, and maintain regulatory compliance.

What are the core applications of AI in the Finance Industry?

AI has become integral to the finance industry by enabling a wide range of core applications that improve efficiency, accuracy, and security. Among the most prominent uses are fraud detection and prevention, where AI systems analyse transaction data in real time to identify and stop suspicious activities before they cause harm. Another key application is algorithmic trading, which leverages AI algorithms to automatically execute trades based on data-driven insights, helping firms capitalize on market opportunities quickly and effectively. These applications showcase how AI enhances traditional financial processes, making them smarter and more responsive to today’s fast-paced financial environment.

Fraud Detection and Prevention

One of the most critical applications of AI in the finance industry is fraud detection and prevention. Financial institutions face constant threats from fraudulent activities that can lead to significant losses and damage customer trust. AI-powered systems use machine learning algorithms to analyse vast amounts of transaction data in real time, identifying unusual patterns or behaviours that might indicate fraud. Unlike traditional rule-based systems, AI models continuously learn from new data, improving their accuracy and reducing false positives. This allows banks and payment processors to detect suspicious activities swiftly, protect customer assets, and comply with regulatory standards.

Algorithmic Trading

Algorithmic trading is another transformative application of AI in finance. It involves using complex AI algorithms to automatically execute trades at speeds and volumes impossible for human traders to match. These algorithms analyze market data, historical trends, and news sentiment to make informed trading decisions. AI-driven trading systems can react instantly to market changes, maximizing profits and minimizing risks. By leveraging machine learning, these models continually refine their strategies, adapting to evolving market conditions. This has made algorithmic trading a dominant force in financial markets, enabling firms to gain competitive advantages through faster, and smarter trading.

What are the benefits of AI in the Finance Industry?

AI brings numerous benefits to the finance industry, fundamentally transforming how financial institutions operate. One of the primary advantages is enhanced accuracy in financial forecasting, as AI systems analyse vast amounts of data from various sources to deliver more precise predictions and insights. This leads to better-informed decisions and more effective risk management. Additionally, AI helps reduce human error and operational costs by automating repetitive tasks such as data processing, compliance checks, and transaction monitoring. This automation not only minimizes mistakes but also boosts efficiency and allows employees to focus on strategic initiatives. Overall, AI is enabling the finance industry to operate more efficiently, securely, and responsively to market changes.

Enhanced Accuracy in Financial Forecasting

One of the most significant benefits of AI in the finance industry is its ability to improve the accuracy of financial forecasting. Traditional forecasting methods often rely on historical data and human judgment, which can be limited by biases and a lack of real-time insights. AI, on the other hand, utilizes advanced algorithms and machine learning techniques to analyse vast amounts of data from multiple sources—such as market trends, economic indicators, and social sentiment—in real time. This enables financial institutions to generate more precise forecasts, helping investors, banks, and businesses make informed decisions and better anticipate market fluctuations.

Reduced Human Error and Operational Costs

Another key advantage of AI is the reduction of human error and operational costs. Manual financial processes, such as data entry, compliance checks, and transaction processing, are prone to mistakes that can be costly and time-consuming to fix. AI-powered automation streamlines these routine tasks by performing them quickly and accurately, minimizing errors and freeing up human resources to focus on higher-value activities. Additionally, automation helps financial institutions reduce operational expenses by increasing efficiency and productivity, which ultimately benefits both the organizations and their customers.

What are the challenges and ethical considerations in AI and the finance industry?

The integration of AI in the finance industry brings several challenges and ethical considerations that must be carefully addressed. Data privacy and security are paramount, as financial institutions handle sensitive customer information that must be protected from breaches and misuse. Additionally, algorithmic bias presents a significant ethical concern, since AI models trained on historical data may unintentionally perpetuate unfair treatment or discrimination. Transparency is also critical, as many AI systems function as “black boxes,” making it difficult to understand how decisions are made, which can affect accountability and trust. To responsibly leverage AI’s benefits, the finance industry must prioritize robust data protection, fairness, and clear explanations of AI-driven decisions.

Data Privacy and Security Concerns

One of the most pressing challenges in the integration of AI and finance industry operations is ensuring data privacy and security. Financial institutions handle vast amounts of sensitive customer information, including personal details and transaction histories. AI systems rely heavily on this data to make accurate predictions and decisions, which raises concerns about how data is collected, stored, and used. Unauthorized access or data breaches could lead to severe financial and reputational damage. Therefore, robust cyber security measures and strict data governance policies are essential to protect customer information and comply with regulations such as GDPR and CCPA.

Algorithmic Bias and Transparency

Another significant ethical consideration involves algorithmic bias and transparency. AI models are trained on historical data, which may contain inherent biases reflecting social or economic inequalities. If unchecked, these biases can lead to unfair treatment of certain groups in areas like loan approvals, credit scoring, or insurance underwriting. Moreover, many AI systems operate as “black boxes,” making it difficult for users and regulators to understand how decisions are made. This lack of transparency can undermine trust and raise accountability issues. To address these concerns, financial organizations must prioritize fairness; explain ability, and regular auditing of AI models to ensure ethical standards are maintained.

How is AI reshaping the finance industry through real-world use cases?

AI is transforming the finance industry in tangible ways through various real-world applications. Leading banks like JPMorgan Chase utilize AI to automate complex document analysis, significantly reducing manual workload and improving accuracy. Fintech companies such as PayPal employ AI-driven fraud detection systems to safeguard millions of transactions daily, enhancing security for users worldwide. Additionally, robo-advisors like Wealthfront use AI to provide personalized investment strategies, making financial planning more accessible and efficient. Beyond traditional finance, AI also plays a crucial role in cryptocurrency and blockchain, where it aids in predicting market trends and securing decentralized transactions. These examples illustrate how AI is reshaping financial services by increasing efficiency, improving security, and delivering smarter decision-making tools.

Case Studies from Leading Banks and Fintech Companies

AI is reshaping the finance industry by enabling leading banks and fintech companies to innovate and streamline their services. For example, JPMorgan Chase uses AI-powered tools like COiN (Contract Intelligence) to review complex legal documents quickly and accurately, saving thousands of hours of manual work. Similarly, PayPal leverages AI algorithms to detect fraudulent transactions in real time, protecting millions of users from financial fraud. Wealthfront, a robo-advisor, uses AI to offer personalized investment advice and automated portfolio management, making sophisticated financial planning accessible to everyday investors. These real-world applications demonstrate how AI enhances efficiency, security, and customer experience in traditional and digital finance sectors.

AI in Cryptocurrency and Blockchain Finance

Beyond traditional finance, AI is making significant strides in cryptocurrency and blockchain technology. AI algorithms analyse vast amounts of market data to predict cryptocurrency price movements, enabling traders and investors to make better decisions in this highly volatile market. Additionally, AI enhances blockchain finance by improving transaction verification processes and detecting suspicious activities on decentralized platforms. The combination of AI and blockchain technology is creating new opportunities for secure, transparent, and efficient financial transactions.

What are the Future Trends in AI and the Finance Industry?

The future of AI and the finance industry is set to be shaped by advancements that prioritize transparency, ethics, and enhanced intelligence. Explainable AI is gaining importance as financial institutions seek to make AI-driven decisions more understandable and accountable, addressing concerns about bias and fairness. Alongside this, ethical fintech innovations are becoming a priority to ensure AI applications align with regulatory standards and customer trust. Additionally, the integration of generative AI with real-time analytics promises to transform financial services by enabling instant insights and personalized interactions. This combination will empower organizations to respond faster to market changes, improve risk management, and offer tailored financial solutions, marking a new era of smart, responsible finance.

Explainable AI and Ethical Fintech Innovations

As AI technologies continue to evolve, one of the most important future trends in the finance industry is the rise of explainable AI. This approach focuses on making AI decisions transparent and understandable to both financial professionals and customers. Explainable AI aims to address concerns around algorithmic bias and accountability by providing clear insights into how AI models reach their conclusions. Coupled with growing attention to ethical fintech innovations, this trend will help build greater trust and compliance in AI-driven financial services, ensuring that ethical standards are maintained while leveraging AI’s power.

Integration of Generative AI and Real-Time Analytics

Another major trend shaping the future of the AI and finance industry is the integration of generative AI with real-time analytics. Generative AI, which can create new content such as reports, financial summaries, and personalized customer interactions, will enhance how financial institutions engage with clients and manage data. When combined with real-time analytics, financial firms can gain instantaneous insights into market conditions, customer behavior, and operational risks, allowing for smarter, faster decision-making. This integration promises to revolutionize portfolio management, risk assessment, and customer service by delivering highly customized and timely financial solutions.

Conclusion

The ai and finance industry is revolutionizing financial decision-making by enabling smarter, faster, and more accurate processes. From risk assessment to personalized investment strategies, AI’s transformative impact is clear. Looking ahead, the future of finance promises increased fairness and transparency as AI technologies continue to evolve. Staying informed and prepared is essential for professionals and organizations to fully leverage the benefits of ai in finance industry innovations. Embracing these advancements will ensure a more efficient, secure, and customer-centric financial landscape.