AI and Accounting: How Artificial Intelligence Is Reshaping Financial Reporting?

How is AI playing a growing role across different industries?

AI and accounting are rapidly evolving together in today’s digital-first world, driving efficiency and innovation across the financial sector. But the impact of artificial intelligence goes far beyond accounting—it is transforming industries such as healthcare, retail, logistics, manufacturing, and customer service. From intelligent chatbots in e-commerce to AI-assisted diagnostics in medicine, nearly every industry is leveraging automation, data analysis, and machine learning to streamline operations and enhance decision-making.

As AI technologies continue to mature, organizations are not only adopting them to gain a competitive edge but also to meet the increasing demand for real-time insights and smarter decision-making. Industries are integrating AI into their core workflows to reduce human error, optimize resource allocation, and uncover hidden patterns in large datasets. This widespread adoption signals a shift toward data-driven operations, where AI acts as a catalyst for innovation, agility, and long-term growth. The accounting profession, in particular, stands at a pivotal point—embracing accounting in AI not as a replacement, but as a powerful tool to elevate financial analysis and reporting accuracy.

The Digital Transformation of Finance and Accounting

In the realm of finance, the shift to automation and intelligent tools has been especially significant. The accounting sector, long reliant on manual data entry and static reporting methods, is undergoing a major technological overhaul. Financial professionals are increasingly relying on AI-powered systems for real-time insights, fraud detection, predictive forecasting, and regulatory compliance. These smart systems can process massive amounts of data far faster and more accurately than traditional methods, freeing accountants to focus on strategic decision-making.

Purpose of this Blog: Understanding the Shift in Financial Reporting

This blog explores how artificial intelligence is reshaping the way organizations handle financial reporting. From automating routine tasks to enabling real-time analytics, AI is redefining what it means to manage financial data. Whether you're an accounting professional, a finance student, or an AI enthusiast, this guide will help you understand the impact of AI on financial systems and why it's essential to adapt to this shift. By the end, you’ll have a clearer picture of how accountings together are shaping the future of business intelligence and compliance.

What is AI in Accounting?

AI in accounting refers to the application of artificial intelligence technologies to automate, enhance, and streamline various financial processes. It involves the use of intelligent systems that can perform tasks such as data analysis, fraud detection, invoice processing, and financial forecasting with little to no human intervention. These systems learn from historical data, recognize patterns, and make decisions based on real-time inputs. By integrating AI into accounting workflows, businesses can reduce manual errors, save time, and gain deeper insights into their financial health. Ultimately, AI in accounting is transforming the role of accountants from data processors to strategic advisors.

Understanding Artificial Intelligence in the Accounting Context

Artificial Intelligence (AI) refers to the simulation of human intelligence in machines designed to perform tasks that typically require human cognition, such as learning, reasoning, and problem-solving. In accounting, AI is transforming traditional financial processes by introducing intelligent systems that can automate tasks, analyse data, and support strategic decision-making with minimal human intervention. AI in accounting goes beyond simple automation. It enables systems to recognize patterns, predict future trends, and even understand the context of financial transactions. These capabilities are allowing accountants and financial teams to move away from time-consuming manual work and toward a more advisory, analytical role within organizations.

Key Technologies Powering AI in Accounting

Several core technologies are driving the integration of AI into accounting systems:

- Machine Learning (ML): This branch of AI allows accounting software to learn from historical data and improve its performance over time. ML algorithms can detect anomalies in financial transactions, forecast cash flows, and assist in budget planning.

- Natural Language Processing (NLP): NLP enables systems to interpret and generate human language. In accounting, this technology is used to automate report generation, interpret legal documents, and even extract data from invoices and receipts.

- Robotic Process Automation (RPA): RPA handles repetitive and rule-based tasks such as data entry, invoice processing, and bank reconciliations. By automating these functions, RPA helps reduce errors and increase efficiency.

The synergy of these technologies exemplifies how AI and accounting work together to enhance accuracy, streamline operations, and empower financial professionals to focus on higher-value tasks. As these tools continue to evolve, their impact on the accounting profession will only grow stronger.

What Does the Traditional Financial Reporting Process Look Like?

The traditional financial reporting process is largely manual and time-consuming, relying on spreadsheets, paper-based documentation, and disconnected legacy systems. Accountants typically gather financial data from various sources, reconcile transactions, and prepare statements like income reports, balance sheets, and cash flow statements. These reports are often generated periodically—monthly, quarterly, or annually—which limits access to real-time insights. This conventional approach is prone to human error, reporting delays, and increased operational costs, especially during audits or financial closings. As businesses grow and financial data becomes more complex, these limitations highlight the growing need for more intelligent solutions—paving the way for innovations in AI and accounting.

An Overview of Conventional Accounting Methods

Before the rise of modern technology, financial reporting was a largely manual, time-intensive process. Traditional accounting relied on spreadsheets, paper records, and legacy software to track income, expenses, and financial statements. Accountants would compile and verify data from various departments, often facing a lag between when a transaction occurred and when it was recorded and reported. This approach was not only time-consuming but also left room for inconsistency and human error. The evolution of accounting in AI is now transforming these outdated methods by introducing automation and real-time data processing.

Common Challenges in Traditional Reporting

While the traditional financial reporting process was standard for decades, it came with several significant limitations. Manual data entry, even by skilled professionals, is prone to errors that can lead to inaccurate financial reports. Additionally, the time required to gather, validate, and compile data often causes delays in reporting, slowing down critical decision-making. These labour-intensive processes also result in higher operational costs, as they demand more staff and longer hours—especially during busy reporting periods. Due to these challenges, many organizations have turned to digital solutions. As technology advances, the demand for faster, more accurate, and real-time financial reporting has become essential. This is where accounting in AI plays a crucial role. AI technologies not only automate repetitive tasks but also deliver valuable strategic insights, helping businesses maintain a competitive edge in today’s rapidly evolving financial landscape.

How AI is Reshaping Financial Reporting?

Artificial intelligence is fundamentally transforming financial reporting by automating routine tasks and enabling real-time data analysis. Traditional accounting processes often involve repetitive manual work such as data entry, reconciliations, and error checking, which can be slow and error-prone. AI-powered tools streamline these tasks, increasing accuracy and efficiency while freeing up professionals to focus on strategic decision-making. Additionally, AI’s ability to analyse vast amounts of financial data instantly provides deeper insights and predictive capabilities, allowing organizations to respond quickly to market changes and regulatory requirements. This fusion of accounting is redefining how financial information is processed and reported, making the entire process faster, more transparent, and more insightful.

Automation of Routine Tasks

One of the most impactful ways AI is transforming financial reporting is through the automation of routine, repetitive tasks. Traditionally, accountants spend significant time on data entry, invoice processing, reconciliations, and error checking—tasks that are not only time-consuming but also prone to human error. AI-powered tools and robotic process automation (RPA) can now handle these processes with remarkable speed and accuracy. By automating these mundane functions, financial teams are freed up to focus on more strategic activities such as analysis and forecasting. This automation reduces operational costs and improves data integrity, enabling organizations to generate financial reports more efficiently than ever before.

Real-Time Data Analysis and Insights

AI also empowers companies to analyse financial data in real-time, providing dynamic insights that were previously impossible with traditional reporting methods. Machine learning algorithms can sift through vast amounts of data, detect anomalies, predict trends, and flag potential risks instantly. This capability allows finance professionals to make informed decisions quickly, respond to market changes, and maintain compliance with evolving regulations. Real-time analytics improve transparency and accuracy, giving businesses a clearer picture of their financial health at any moment.

What are the Benefits of Using AI in Accounting?

Using AI in accounting offers numerous benefits, including improved accuracy and enhanced efficiency. AI-powered tools reduce the risk of human error by automating repetitive and data-intensive tasks such as data entry, reconciliation, and report generation. This automation not only speeds up these processes but also ensures that financial information is more reliable. Additionally, AI enables faster decision-making by leveraging predictive analytics, which can analyse historical data to forecast trends, identify potential risks, and support strategic planning. The integration of accounting is thus helping businesses streamline operations, reduce costs, and gain valuable insights, ultimately transforming accounting into a more strategic and proactive function.

Improved Accuracy and Efficiency

One of the primary benefits of integrating AI into accounting processes is the significant improvement in both accuracy and efficiency. Traditional accounting methods involve extensive manual data entry and reconciliation, which are prone to human errors such as miscalculations or data omissions. AI systems, powered by machine learning and automation, can process vast amounts of financial data quickly and with a much lower risk of errors. This not only improves the reliability of financial reports but also accelerates routine tasks, allowing accounting teams to operate more efficiently. By automating repetitive functions like invoice processing, transaction matching, and audit trails, AI reduces the time and resources needed to maintain accurate financial records.

Faster Decision-Making with Predictive Analytics

AI also enhances decision-making through predictive analytics, a powerful tool that analyses historical data to forecast future trends. In accounting, this capability helps businesses anticipate cash flow needs, detect potential fraud, and identify financial risks before they become critical issues. By providing real-time insights and projections, AI enables finance professionals to make informed decisions quickly, improving strategic planning and risk management. This agility is crucial in today’s fast-paced business environment, where timely and accurate financial information can be a significant competitive advantage.

What are the Key Use Cases and Tools in AI-Powered Accounting?

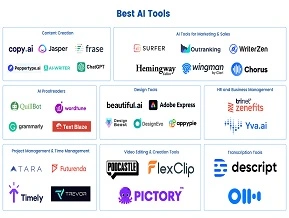

AI-powered accounting is transforming the finance industry by automating routine tasks and providing advanced data analysis tools that enhance accuracy and efficiency. Key use cases include automating account reconciliations, fraud detection, invoice processing, and real-time financial reporting. Popular AI tools such as BlackLine, MindBridge, Xero, and QuickBooks integrate machine learning and automation to simplify complex processes and reduce manual effort. These tools enable businesses to streamline their financial operations while gaining deeper insights into their financial health. The integration of accounting is helping firms—from small businesses to large enterprises—improve compliance, speed up reporting cycles, and make more informed decisions based on real-time data.

Popular AI Tools Used in Finance

AI technology is becoming increasingly prevalent in accounting through a variety of powerful tools designed to automate and optimize financial processes. Popular AI-powered platforms such as BlackLine, MindBridge, Xero, and QuickBooks with AI integrations have revolutionized the way organizations handle accounting tasks. BlackLine, for example, focuses on automating account reconciliations and financial close processes, reducing manual effort and improving accuracy. MindBridge uses AI-driven analytics to detect anomalies and potential fraud in financial data. Meanwhile, cloud-based solutions like Xero and QuickBooks incorporate AI features to streamline bookkeeping, automate invoice processing, and provide real-time financial insights. These tools not only enhance efficiency but also help accounting teams make smarter, data-driven decisions.

Case Studies: Firms Implementing AI in Financial Reporting

Numerous firms worldwide are adopting AI to transform their financial reporting practices. For instance, some large multinational corporations have integrated AI platforms to automate repetitive tasks such as data entry and audit preparation, resulting in significant time savings and reduced errors. Others use AI-powered analytics to gain deeper insights into financial performance, enabling proactive risk management and more accurate forecasting. Small and medium-sized businesses are also benefiting by using accessible AI accounting software to simplify tax preparation and compliance. These real-world implementations demonstrate the growing impact of ai and accounting in driving operational excellence and strategic growth.

What are the Challenges and Ethical Considerations?

As AI continues to transform accounting, it brings with it a set of challenges and ethical considerations that organizations must carefully navigate. Key concerns include data security and privacy, as financial information is highly sensitive and requires stringent protection against breaches and misuse. Additionally, the rise of AI raises important questions about its impact on jobs within the accounting profession—whether AI will displace workers or simply change the nature of their roles. Balancing the advantages of AI automation with responsible data management and workforce adaptation is essential to ensure ethical and sustainable implementation of AI in accounting. The evolving relationship between accounting demands ongoing attention to these issues to build trust and maximize benefits.

Data Security and Privacy Concerns

As AI becomes more integrated into accounting systems, data security and privacy emerge as critical challenges. Financial data is highly sensitive, and the use of AI requires collecting and processing vast amounts of this information. Organizations must ensure that AI systems comply with data protection regulations and employ robust cyber security measures to prevent unauthorized access, data breaches, and misuse. The complexity of AI models can also make it difficult to fully understand how decisions are made, raising concerns about transparency and accountability. Protecting client and company data while leveraging AI’s capabilities requires careful planning and ongoing vigilance.

Job Displacement vs. Job Transformation

Another major ethical consideration involves the impact of AI on the workforce. While AI automates many routine accounting tasks, this raises fears of job displacement for accounting professionals. However, rather than replacing jobs entirely, AI is more likely to transform roles within the industry. Accountants may shift focus from manual data entry and reconciliation to more strategic functions such as analysis, interpretation, and advising based on AI-generated insights. Preparing the workforce for this transition through training and upskilling is essential to ensure professionals can work alongside AI tools effectively. Balancing technological advancement with human expertise is key to ethical implementation.

Conclusion:

AI and accounting are reshaping the future of financial reporting by automating routine tasks and providing deeper insights through advanced analytics. This transformation enhances accuracy, efficiency, and decision-making in the finance sector. The rise of accounting in AI highlights the importance of balancing cutting-edge technology with human expertise to ensure ethical practices and strategic value. For those interested in mastering this evolving field, LAI offers comprehensive courses on AI in finance that equip learners with the skills needed to thrive. Explore these opportunities to stay ahead in the rapidly changing world of accounting and financial technology.