Why Accounting Software and AI are the Future of Finance?

What are the Evolution of Accounting Software and AI Integration?

Accounting software and AI are transforming how businesses manage their finances—from manual spreadsheets to intelligent, automated systems. This evolution marks a significant shift in efficiency, accuracy, and decision-making within the world of finance and accounting.

From Spreadsheets to Automation

In the early days of digital accounting, spreadsheets like Microsoft Excel dominated. They allowed businesses to organize and calculate financial data, but still required manual data entry and were prone to human error. The 1990s and early 2000s saw the emergence of desktop-based accounting software like QuickBooks and Tally, which introduced features such as automated invoicing and payroll processing.

Cloud-Based Solutions and Mobile Access

As internet speeds improved, accounting tools moved to the cloud. Cloud-based platforms like Xero and FreshBooks enabled real-time data access, remote collaboration, and automatic syncing with bank feeds. This drastically reduced paperwork and simplified compliance for small to mid-sized businesses.

The Rise of AI in Accounting Software

Around the mid-2010s, AI in accounting software began gaining traction. AI features were first introduced for automating data entry, detecting duplicate transactions, and flagging inconsistencies. Over time, machine learning models began predicting cash flow, categorizing expenses intelligently, and providing financial insights through dashboards and reports.

AI now plays a key role in fraud detection, audit preparation, and even chatbot-based customer support for accounting platforms. It reduces manual workload while increasing accuracy and compliance.

A Smarter Future Ahead

Today, accounting software is more than just a ledger—it’s a smart system capable of analysing data, learning from it, and helping businesses make better financial decisions. As AI continues to evolve, its integration with accounting systems will become even deeper, reshaping the future of finance and business management.

How AI in Accounting Software is Revolutionizing Financial Management?

AI in accounting software is transforming financial management by automating routine tasks, improving accuracy, and offering real-time insights. This powerful integration of technology is enabling businesses to operate smarter, faster, and more strategically than ever before.

What AI Brings to the Table

Artificial intelligence brings automation, intelligence, and scalability to traditional accounting processes. It eliminates repetitive tasks like data entry and transaction matching, allowing accountants to focus on analysis and strategy. AI also enhances accuracy by reducing human error and identifying anomalies or fraud risks that may be missed manually.

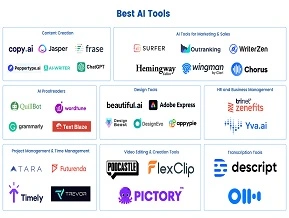

Examples of AI-Driven Tools and Features

Modern integration includes tools like:

- Automated expense categorization based on historical behaviour and patterns

- Predictive analytics for forecasting cash flow and revenue trends

- AI-powered chatbots for answering common accounting queries in real time

- Smart invoice processing that extracts data from documents and enters it automatically

- Fraud detection systems that analyse transaction patterns and flag unusual activities

Platforms like QuickBooks, Xero, and Zoho Books have already adopted these features, allowing even small businesses to access enterprise-level financial intelligence.

Real-World Applications

A mid-sized eCommerce company, for example, used AI-powered software to reduce monthly reconciliation time by 60% and detect over $10,000 in duplicate payments annually. Similarly, a freelance consultant benefited from AI-generated financial summaries, helping them track profitability without needing a full-time accountant.

Looking Ahead

The combination of these is not just a trend—it’s a game-changer. As AI continues to evolve, its role in financial management will deepen, helping organizations of all sizes make faster, smarter financial decisions.

What is the Synergy between Human Accountants and AI in Accounting Software?

The rise of artificial intelligence in finance has sparked concerns about job security, but the reality is clear: AI isn’t here to replace accountants—it’s here to empower them. The true strength lies in the synergy between human expertise and smart technology.

AI as a Powerful Tool

AI excels at automating repetitive and data-intensive tasks such as data entry, invoice matching, and transaction categorization. These functions, once time-consuming, can now be executed instantly and with high accuracy. This frees accountants to focus on tasks that require critical thinking, creativity, and strategic insight.

Enhancing Decision-Making, Not Replacing It

Rather than replacing human judgment, AI in accounting software enhances it. Accountants still interpret financial data, apply regulatory knowledge, and advise clients—now with the added support of real-time insights and predictive analytics. AI tools can surface trends or red flags, but it’s up to the human accountant to determine the implications and next steps.

The Evolving Role of Accountants

As AI takes on more of the “heavy lifting,” the role of accountants is shifting toward advisory and analytical functions. They’re becoming strategic partners who help businesses plan for growth, mitigate risk, and navigate complex financial regulations. Soft skills such as communication, ethical judgment, and problem-solving are more vital than ever in this AI-enhanced environment.

In conclusion, the integration of technology doesn't diminish the importance of accountants—it redefines it. The future of finance depends not on man versus machine, but on how well they work together. Embracing the synergy between human professionals and AI will lead to smarter, more efficient, and more strategic accounting practices.

What are the Key Benefits of Using Accounting Software and AI Together?

Combining intelligent automation with financial management tools is transforming how businesses handle accounting tasks. When used together, accounting software and artificial intelligence (AI) create a more accurate, efficient, and strategic approach to managing company finances.

Improved Accuracy and Speed

Manual data entry and processing often result in errors that can impact financial reporting and decision-making. AI-powered accounting software minimizes human error by automatically categorizing transactions, reconciling bank statements, and detecting inconsistencies. These processes happen in real-time, dramatically increasing both accuracy and speed.

Proactive Financial Forecasting

Traditional accounting systems report on what has already happened. In contrast, AI enables predictive analytics by identifying patterns in historical data and projecting future financial outcomes. Businesses can use this information to make proactive decisions—like adjusting budgets or preparing for seasonal changes in revenue.

Reduced Operational Costs

Automating repetitive tasks such as invoice processing, payroll management, and expense reporting reduces the need for extensive manual labour. This leads to leaner operations and allows accounting teams to focus on higher-value activities, such as financial planning and strategic analysis.

Better Compliance and Fraud Detection

AI tools help businesses stay compliant by monitoring for irregularities and ensuring reports meet regulatory standards. They can also flag potentially fraudulent transactions by analysing data patterns and identifying anomalies that might go unnoticed by human review.

In short, using accounting software and AI together doesn’t just streamline accounting—it transforms it. From real-time insights to strategic foresight, this combination delivers powerful advantages that help businesses stay competitive, efficient, and financially sound.

What are the Challenges and Considerations in Adopting AI in Accounting Software?

While the benefits of artificial intelligence in finance are substantial, implementing AI in accounting software comes with its own set of challenges. Businesses must navigate technical, ethical, and organizational hurdles to fully realize its potential.

Data Privacy, Ethics, and Bias

One of the most pressing concerns is data privacy. Financial data is highly sensitive, and relying on AI systems means trusting them to handle confidential information responsibly. Companies must ensure that AI tools comply with data protection laws and are designed with privacy in mind. In addition, ethical concerns—such as algorithmic bias—can lead to skewed results if AI is trained on biased or incomplete data sets.

Integration with Legacy Systems

Many organizations still rely on legacy accounting systems that may not be compatible with modern AI tools. Integrating new AI-driven functionalities with existing infrastructure can be costly and time-consuming. Without seamless integration, the efficiency gains promised by AI may never fully materialize.

Skills Gap and User Adoption

Adopting AI in accounting software also highlights a growing skills gap. Many finance professionals lack the technical expertise needed to work effectively with AI tools. Training staff to understand, trust, and use these systems is essential, but it can be a slow and resource-intensive process. Additionally, resistance to change can delay or derail AI implementation entirely.

Balancing Innovation with Caution

Despite these challenges, the potential rewards of AI are too significant to ignore. Businesses must balance innovation with caution—adopting secure, transparent, and well-integrated solutions while investing in user education and support.

Ultimately, a thoughtful and well-managed approach to AI adoption can help organizations avoid pitfalls and maximize the long-term value of intelligent accounting systems.

What are the Future Trends in AI and Accounting Software?

The future of finance is rapidly evolving, and artificial intelligence is at the centre of this transformation. From predictive analytics to smart assistants, the next generation of accounting tools will be more proactive, intelligent, and user-friendly than ever before.

Predictive Finance and Intelligent Automation

AI will move beyond automating repetitive tasks to enabling true predictive finance. Future systems will not only track past financial activity but also forecast future trends—like revenue changes, expense spikes, or cash flow gaps—helping businesses plan more effectively. Intelligent automation will take over more complex processes, such as budgeting and financial modelling, with minimal human intervention.

AI in Audits and Tax Compliance

One of the most promising developments is the use of AI in accounting software for audits and tax compliance. AI can quickly analyse vast amounts of transactional data, highlight discrepancies, and ensure that records align with current tax laws and reporting standards. This reduces the margin for error and speeds up the audit process significantly.

Natural Language Queries and AI Assistants

Future accounting platforms will likely include natural language processing capabilities, allowing users to ask financial questions in plain English. Instead of navigating menus or running complex reports, a user might simply ask, “What were our total marketing expenses last quarter?” and receive an instant, accurate answer. AI assistants will also provide on-demand insights and suggestions, functioning much like a virtual CFO.

Looking Ahead

As technology continues to evolve, businesses that embrace AI-driven accounting tools will gain a competitive edge. The future will be defined not just by faster processes, but by smarter, more strategic financial management powered by intelligent technology.

What is the Role of AI Education in Shaping the Future of Finance?

As AI continues to reshape the finance industry, staying ahead requires a commitment to learning and adaptation. Understanding AI is no longer optional for finance professionals—it’s essential for future success.

Upskilling for the Future of Work

The finance sector is evolving rapidly, with AI automating routine tasks and enabling more advanced analysis. To remain relevant, professionals must upskill by learning how to work alongside AI tools. This includes understanding AI concepts, data literacy, and the ability to interpret AI-driven insights. Upskilling prepares finance teams to harness the full potential of emerging technologies rather than be displaced by them.

Why Finance Professionals Must Learn AI

AI is increasingly integrated into everyday finance operations. For example, AI in accounting software is revolutionizing how companies handle bookkeeping, forecasting, and compliance. Professionals who understand how AI works can better leverage these tools to improve accuracy, efficiency, and strategic decision-making. Moreover, knowledge of AI enables professionals to critically assess AI outputs, ensuring ethical use and mitigating risks like bias or error.

How LAI Equips Learners with AI Knowledge

LAI offers specialized courses that bridge finance and AI education, empowering learners to develop both technical skills and strategic insights. These programs focus on practical applications of AI in finance, including automation, predictive analytics, and AI-driven decision-making. With hands-on training and expert guidance, LAI helps finance professionals confidently navigate the AI-powered future.

Embracing the Future

As AI becomes central to financial management, education is the key to unlocking its benefits. By embracing AI learning, finance professionals can enhance their careers and contribute meaningfully to their organizations' success.

Conclusion

AI is rapidly transforming the finance industry, bringing greater efficiency, accuracy, and strategic insight to financial management. Understanding AI and its applications, such as AI in accounting software, is essential for professionals to stay competitive and effective in their roles. By embracing these technological advancements and upskilling accordingly, finance experts can unlock new opportunities and drive innovation within their organizations. For those looking to future-proof their careers and deepen their AI knowledge, exploring AI learning opportunities with LAI is a smart and proactive step toward mastering the finance of tomorrow.