Accounting and AI: Why the Smartest Firms are Adopting AI Now?

How Has Accounting Evolved in the Age of AI?

In today’s digital-first business world, the relationship between _accounting and AI_ is transforming how financial professionals work, think, and add value. No longer confined to spreadsheets and manual entries, modern accountants are now leveraging AI technologies to streamline operations, enhance accuracy, and deliver smarter financial strategies. From automating routine tasks such as data entry and reconciliation to generating real-time insights and predictive analytics, AI is not just assisting accountants—it’s reshaping the very core of the profession. As businesses demand faster, more reliable financial intelligence, AI is emerging as an essential tool in the accountant’s toolkit, driving a new era of efficiency and innovation in the accounting landscape.

Traditional Accounting: Manual, Time-Intensive, and Prone to Error

Before the introduction of AI, accounting was heavily dependent on manual processes. Accountants spent countless hours on data entry, reconciliation, and report generation. Financial records were often maintained using spreadsheets or outdated software systems. While these methods were functional, they were time-consuming and left significant room for human error. Additionally, professionals had limited tools to analyse large data sets quickly, which slowed down decision-making and auditing processes.

The Shift toward AI-Enhanced Accounting

With the rise of artificial intelligence, modern accounting is experiencing a major shift. AI systems can now automate repetitive tasks like invoice processing, categorizing transactions, and even detecting anomalies in financial data. This not only increases accuracy but also allows accountants to focus on strategic planning and advisory roles. Moreover, AI-powered tools offer predictive analytics and real-time reporting, helping firms make faster, data-driven decisions. Cloud accounting platforms integrated with machine learning further streamline operations, making remote work and client collaboration easier than ever.

How Do Accounting and AI Work Together in today’s Financial World?

The rise of digital tools and automation has made _ai in accounting_ a game-changer for firms aiming to modernize their financial operations. As businesses increasingly rely on data-driven decision-making, AI is stepping in to handle time-consuming, repetitive tasks with speed and precision. From enhancing productivity and improving accuracy to enabling deeper financial insights, AI is not just an upgrade—it’s a fundamental shift in how accounting is performed. By streamlining workflows, minimizing human error, and uncovering patterns in large datasets, AI empowers accountants to move beyond number-crunching and take on more strategic, advisory roles. This evolution is redefining the accounting profession and setting new standards for efficiency, intelligence, and value creation.

What Is AI in the Context of Accounting?

Artificial Intelligence (AI) refers to the simulation of human intelligence by machines, especially computer systems capable of learning, reasoning, and self-correction. In accounting, AI is used to analyse data, recognize patterns, and make informed decisions—often in real time. Rather than replacing accountants, AI is empowering them to shift from repetitive tasks to more analytical and strategic roles. This means professionals can focus on delivering deeper financial insights, improving client services, and driving business value.

Types of AI Technologies Used in Accounting

Several AI-driven technologies are being integrated into accounting workflows:

- Machine Learning (ML): ML algorithms learn from historical financial data to identify trends, detect anomalies, and make predictions. For example, they can forecast future expenses or flag suspicious transactions.

- Natural Language Processing (NLP): NLP allows AI to interpret and generate human language, enabling the automation of document review, contract analysis, and chatbot-based client interactions.

- Robotic Process Automation (RPA): RPA automates routine, rule-based tasks like invoice processing, account reconciliation, and payroll entry, reducing errors and saving time.

- Optical Character Recognition (OCR): OCR converts physical documents into digital data, streamlining audits and record-keeping.

What are the Top Benefits of AI in Accounting for Modern Firms?

As technology continues to reshape the financial sector, the impact of _AI in accounting_ is becoming impossible to ignore. This powerful combination of artificial intelligence and financial expertise is transforming how modern firms operate—streamlining workflows, enhancing compliance, and elevating the quality of services offered. From reducing manual workloads that once consumed hours of staff time to enhancing real-time decision-making through data analytics, AI is enabling firms to be faster, more accurate, and more responsive to client needs. In a world where financial agility and precision are essential, AI is no longer a luxury—it’s becoming a strategic necessity for firms aiming to stay competitive in a rapidly evolving, data-driven business environment.

Improved Accuracy and Reduction in Human Error

One of the most significant advantages of AI is its ability to process vast amounts of financial data with high precision. Traditional accounting methods are prone to human error, especially when it comes to repetitive tasks like data entry, reconciliations, and transaction matching. AI eliminates much of this risk by automating these tasks using algorithms that are capable of identifying inconsistencies and flagging anomalies instantly.

Time and Cost Savings through Automation

AI-powered automation enables firms to handle routine accounting tasks faster and more efficiently. Activities that once required hours—such as invoice processing, payroll calculations, and tax filings—can now be completed in a fraction of the time. This results in significant cost savings, as fewer resources are needed to perform high-volume work. It also frees up accountants to focus on strategic analysis, financial planning, and client consulting—roles that add greater value and increase firm profitability.

What are the Key Applications of AI in Accounting?

The integration of _AI in accounting_ is revolutionizing the way firms manage their most critical financial processes. By automating routine tasks and providing intelligent data analysis, AI is helping accounting teams operate faster and with greater precision than ever before. This transformation is not just about speed—it's also about enhancing accuracy to reduce costly errors and improving security to protect sensitive financial information.

AI-Powered Bookkeeping and Data Entry

One of the most fundamental applications of AI in accounting is automating bookkeeping and data entry. Traditionally, these tasks have been manual and time-consuming, requiring accountants to input large volumes of financial data and verify its accuracy. AI technologies, such as machine learning algorithms and robotic process automation (RPA), can now extract, classify, and enter financial data from invoices, receipts, and bank statements automatically.

Fraud Detection and Compliance Monitoring

Another vital application of AI in accounting lies in enhancing security and compliance. AI systems can analyse vast amounts of transactional data in real time, identifying unusual patterns and flagging potential fraud much faster than traditional methods. By detecting anomalies such as duplicate invoices, unusual payments, or unauthorized access, AI helps firms prevent financial losses and reputational damage.

Why the Smartest Firms Are Investing in Accounting and AI Now?

The combination of _accounting and AI_ is rapidly becoming a defining factor for firms aiming to stay competitive in today’s fast-paced and ever-evolving financial environment. As businesses face increasing demands for accuracy, speed, and regulatory compliance, the pressure to innovate has never been greater. Early adoption of AI technologies provides companies with significant advantages that go far beyond simple automation of repetitive tasks. It empowers firms to harness advanced data analytics, improve forecasting accuracy, and deliver more strategic insights to clients.

Competitive Advantages of Early AI Adoption

Firms that embrace AI in their accounting processes gain a competitive edge through improved efficiency, accuracy, and decision-making. Automating routine tasks allows accountants to focus on strategic activities like financial analysis and advising clients. Early adopters benefit from faster reporting cycles and real-time insights, enabling them to respond quickly to market changes and regulatory updates.

Case Studies and Success Stories

Leading accounting firms, including the Big Four—Deloitte, PwC, EY, and KPMG—have invested heavily in AI to transform their services. For example, Deloitte uses AI-powered tools for auditing and fraud detection, drastically reducing the time needed to analyse complex data. Similarly, startups focused on AI-driven accounting solutions are disrupting traditional practices by offering more affordable and efficient alternatives.

What are the Challenges and Considerations in Using AI in Accounting?

While the benefits of _AI in accounting_ are clear and increasingly transformative, firms must also navigate several significant challenges and considerations to successfully implement these advanced technologies. Deploying AI is not simply about installing new software—it involves rethinking workflows, ensuring data integrity, and managing change within the organization. Without a clear strategy, firms risk encountering pitfalls such as data breaches, integration difficulties, or resistance from staff unfamiliar with AI tools. Understanding and proactively addressing these issues is crucial for companies that want to harness AI’s full potential while minimizing operational and security risks.

Data Privacy and Security Concerns

One of the biggest challenges in adopting AI is ensuring data privacy and security. Accounting involves handling sensitive financial information, including client data and proprietary business details. Integrating AI systems raises concerns about unauthorized access, data breaches, and compliance with regulations such as GDPR and HIPAA.

Integration with Legacy Systems

Another significant consideration is how AI integrates with existing legacy accounting systems. Many firms rely on established software that may not be compatible with modern AI solutions. This incompatibility can lead to costly and complex IT projects, potentially disrupting daily operations. To overcome this, companies need to plan carefully and possibly invest in middleware or APIs that enable seamless communication between AI tools and legacy platforms

How Can Firms Get Started with Adopting AI in Accounting?

For small and mid-size accounting firms, embracing AI in accounting may initially seem daunting due to limited resources, budget constraints, and concerns about technical complexity. However, with a well-planned and structured approach, the transition to AI-powered accounting can become not only manageable but also highly rewarding. By breaking down the adoption process into clear, actionable steps, these firms can gradually integrate AI technologies into their workflows without disrupting day-to-day operations.

Steps for AI Adoption in Small and Mid-Size Firms

The first step is to assess current accounting processes and identify tasks that can benefit most from automation and AI-driven insights. Firms should prioritize repetitive, time-consuming activities such as data entry, invoice processing, and reconciliation, where AI can immediately improve efficiency and accuracy. Next, it’s important to build internal awareness and train staff on the benefits and functionalities of AI tools. A gradual rollout, starting with pilot projects, allows firms to test AI applications on a small scale, gather feedback, and refine workflows before full implementation.

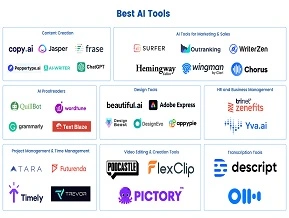

Choosing the Right AI Tools and Platforms

Selecting the appropriate AI tools is crucial for success. Firms should look for platforms that integrate seamlessly with their existing accounting software and offer user-friendly interfaces. Cloud-based AI solutions are often ideal for small and mid-size firms due to their scalability and lower upfront costs.

What are the Future of Accounting and AI?

The future of accounting and AI promises to fundamentally revolutionize the way financial tasks are performed, transforming not only day-to-day operations but also the broader strategic role of accounting professionals. With AI technologies advancing at an unprecedented pace, firms can expect significant improvements in efficiency, accuracy, and the ability to generate deeper insights from financial data. This shift will enable accountants to move beyond routine number-crunching and focus more on analysis, forecasting, and advising clients with strategic guidance.

Rise of Autonomous Accounting Systems

One of the most exciting trends is the rise of autonomous accounting systems. These AI-powered platforms can handle end-to-end financial processes with minimal human intervention, from bookkeeping and invoicing to tax preparation and audit support. By automating routine tasks, autonomous systems free accountants to focus on higher-level analysis, strategic planning, and client advisory roles. As these systems become more sophisticated, they will be able to predict financial trends, detect anomalies, and offer real-time insights, making accounting more proactive and predictive than ever before.

Growing Demand for AI-Literate Accountants

As AI takes over repetitive functions, there is a growing demand for accountants who understand how to work alongside AI tools. Future accountants will need to be proficient not only in traditional accounting principles but also in data analytics, AI applications, and cyber security. This shift calls for enhanced education and training programs that equip professionals with the skills to interpret AI-generated insights and ensure ethical and secure use of technology. Firms investing in up skilling their teams will be better positioned to thrive in this evolving landscape.

Conclusion

The integration of accounting and AI is no longer optional—it’s essential for firms wanting to stay competitive and efficient in today’s fast-changing financial world. Acting now to adopt AI technologies will help businesses reduces errors, save time, and unlock powerful insights that drive smarter decisions. To stay ahead, accountants must embrace AI in accounting as a core part of their skill set. Explore LAI’s comprehensive AI courses to future-proof your accounting career or business and lead confidently into the digital age.